FCTA's MONTHLY MESSAGE - November 2022

-- by David Swink, 11/29/2022

'Good Reads', a Cure for Wokeness?

Many of us were surprised that the November election results produced a "red trickle" rather than the anticipated "red wave" -- given the woeful Atlas-Shrugged-like state of the nation. The Left was able to get Gen-Z and Millennials out in force, and -- with their K-16 indoctrination in wokeness -- was thus able to largely maintain the dreadful status quo.

Now we all know that most young people start out inclined to vote with the left, and move to the right as they gain maturity. But public schools in America have for decades been de-emphasizing critical thinking skills, emphasizing so-called "social emotional learning" (SEL), and of late have branched out into the Marxist Critical Race Theory (CRT) and destuctive transgender grooming. This borders on child abuse, and at best renders the upcoming generation with "skulls full of mush" (a Rush Limbaugh depiction), leaving K-16 graduates woefully unprepared to successfully navigate in the real world (and to vote intelligently).

When this writer graduated from Fairfax County Public Schools in 1962, he had been required to read and discuss a number of the great works of Western literature, including Moby Dick, Great Expectations, The Scarlet Letter, and Animal Farm. These and other great works teach us life's lessons and provide valuable perspective from human history in Western civilization. Life's lessons include honor, integrity, courage, steadfastness, moderation, humility, manliness, femininity, and manners -- virtues sadly not adequately addressed in today's culture. So what to do?

This writer (and FCTA webmaster) noted that the Great Works were by-and-large available somewhere on the internet, but there was no central location where these works were consolidated and their content made accessible. This is now fixed: "Good Reads: Full Text of Classics in Western Literature" (Ref http://fcta.org/books/). But of course who wants to read an entire book from their computer? -- one should buy the paperback. The point is: there's now one location where these Great Works can be found and referenced!

Well, so what!? Studious parents -- if they know about our 'Good Reads' site -- may be encouraged to ask their kids what they're being assigned in school, and to perhaps add some required reading of their own. Such extra reading would certainly help to counterbalance some of the brainwashing encountered in the schools. FCTA may even consider buying sheets of those smartphone-readable QR code stickers to append to those hundreds of street-side mini-libraries throughout Fairfax County. What say you?

Fairfax County Taxpayers Alliance is fighting for you!

Thanks for your support.

FCTA.org

FCTA's MONTHLY MESSAGE - June 2022

-- by Arthur Purves, FCTA President, 06/22/2022

Fairfax County Homeowners to Get a $600 (8%) Tax Hike -- Taxation by Misrepresentation -- (Printable)

- Note: Also posted on The Bull Elephant, Bacon's Rebellion, and Fairfax County Times.

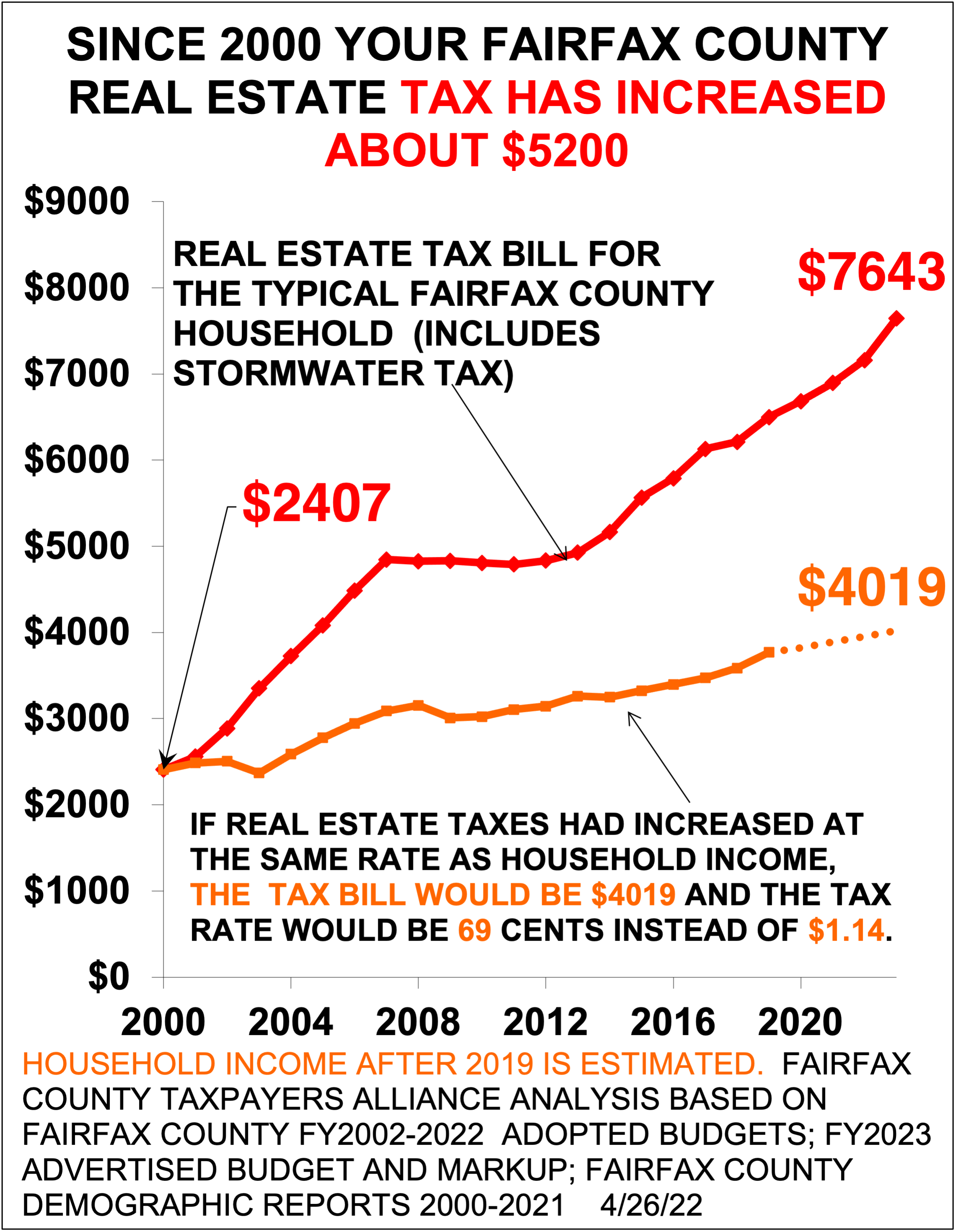

Around June 28 Fairfax County homeowners will get their real estate tax bill, which is due July 28. The typical homeowner's real estate tax bill will increase by $484 or 6.8%, from $7,159 to $7,643.

|

Around Sept. 5, Fairfax County car owners will get their personal property tax bill, which is due Oct. 5. The typical household's personal property tax will increase by $151 or 36%, from $420 to $571.

Combining real estate and property tax increases, the typical household will have a $634 or 8.4% tax increase. This is the largest increase since Gerry Connolly's 9.7% increase in 2006, at the end of the housing bubble. (When he was county chairman, Congressman Connolly increased taxes 15% in 2003, which makes him the record holder for the largest tax increase since 1982.)

However, if you read county chairman Jeff McKay's April 26, 2022, newsletter about next year's budget, you'd think your taxes are going down.

First, he says that the supervisors lowered the tax rate 3 cents, from $1.14 to $1.11. In fact, the supervisors increased the tax rate, since $1.11 is 7 cents higher than the $1.04 rate which would have prevented a tax increase due to higher assessments.

Virginia Code Section 58.1-3321 requires supervisors to compare the new rate of $1.11 not to the current $1.14 rate but to a lower rate that would offset the increase in assessments. For homeowners that "lowered" rate is $1.04. Chairman McKay ignores the Virginia Code.

Also, Chairman McKay left out the stormwater tax, which is also based on assessments. The stormwater rate is $0.0325, so the total real estate tax rate is $1.1425, and not $1.11.

Second, Chairman McKay says, "The Board also agreed to a 15% reduction in the assessment of personal property (car tax), ..." However, used car values have increased so much that even with this 15% "reduction", the typical household's car tax bill will increase 36%.

Third, Chairman McKay cites "expanded tax relief for seniors", which will increase the number of seniors eligible for tax relief by 2,000. There are about 160,000 seniors in the county, so the expanded tax relief benefits only about 1% of seniors.

Under compensation, Chairman McKay says all county employees are getting 4% raises. However, the supervisors' budget package states that there will be "... average pay increases of 7.86 percent for uniformed public safety employees and 6.16 percent for non-uniformed employees ..."

All told, county revenue increases next year total $246 million. The total cost of raises and rate hikes for benefits for the county and schools (school employees are also getting 6% raises) is $252 million. So, the quarter-of-a-billion-dollar tax hike is all for raises and benefits.

Chairman McKay's newsletter does not mention this. Instead, he says, "In total, this budget provides $199.4 million in tax relief."

This is taxation by misrepresentation.

What he means is that the supervisors were thinking of raising taxes and other revenues by $445 million, but instead they only raised taxes and revenues by $246 million.

Suppose Chairman McKay had said that the supervisors effectively raised the real estate tax rate 7 cents rather than decreasing it 3-cents; that the rate is actually $1.14, not $1.11; that the car tax is going up 36%, not down 15%, that county employees are getting raises of 6% and 7%, not 4%, and that county revenues are increasing $246 million to pay for the raises and not going down by $199 million.

Would that jeopardize Chairman McKay’s reelection next year?

Fairfax County Taxpayers Alliance is fighting for you!

Thanks for your support.

FCTA.org

FCTA's MONTHLY MESSAGE - April 2022

-- by Arthur Purves, FCTA President, 04/23/2022

"Any Rate Reduction of Less Than 10¢ Is a Tax Hike!"

- The following is testimony of the Fairfax County Taxpayers Alliance at the April 12 Board of Supervisors hearing on the effective tax rate increase. FCTA testimony is mentioned in a Fairfax Times article on the budget hearings.

Members of the Board:

Thank you for the opportunity to testify. I am Arthur Purves and address you as president of the Fairfax County Taxpayers Alliance.

Virginia Code Section 58.1-3321 requires that you hold this hearing and that you publicize it. The purpose is to let voters know that the supervisors can prevent a real estate tax increase due to higher assessments by reducing the real estate tax rate ten cents.

Many believe that if assessments increase, real estate taxes have to increase. This is false. The supervisors can prevent a tax increase due to higher assessments by lowering the tax rate.

To prevent a tax increase for homeowners next year, Mr. Chairman, you and the board can reduce the tax rate ten cents.

However, this hearing and the ability to prevent a real estate tax increase by reducing the rate by ten cents is one of the county's best-kept secrets. The ten-cent reduction is not mentioned anywhere in the county's 1400-page FY2023 Advertised Budget Plan. The ten-cent reduction is not mentioned in budget press releases. The ten-cent reduction is not mentioned in supervisor newsletters. The ten-cent reduction is not mentioned in town halls. Even this hearing's legally required announcement that you publish in the Washington Times, does not mention the ten-cent reduction.

One might conclude that the supervisors do not want voters and taxpayers to know that a ten-cent reduction in the tax rate would prevent a real estate tax increase, perhaps because knowledge of that fact would jeopardize the supervisors' reelection next year.

Note, any rate reduction of less than ten cents will result in a tax hike for homeowners. If you reduce the rate eight cents, that still results in a tax hike. If you reduce the rate 5 cents, that's a bigger tax hike. If you reduce the rate only 2 or 3 cents, that is an enormous tax hike.

If you believe that taxpayers would vote you out of office if they knew that you hiked taxes by failing to reduce the rate ten cents, then maybe you should reduce rate by ten cents.

However, by not reducing the rate, you get an extra $250 million. That's a quarter of a billion dollars. You want that money because you have promised 37,000 county and school employees 6% raises next year, and those raises cost $250 million.

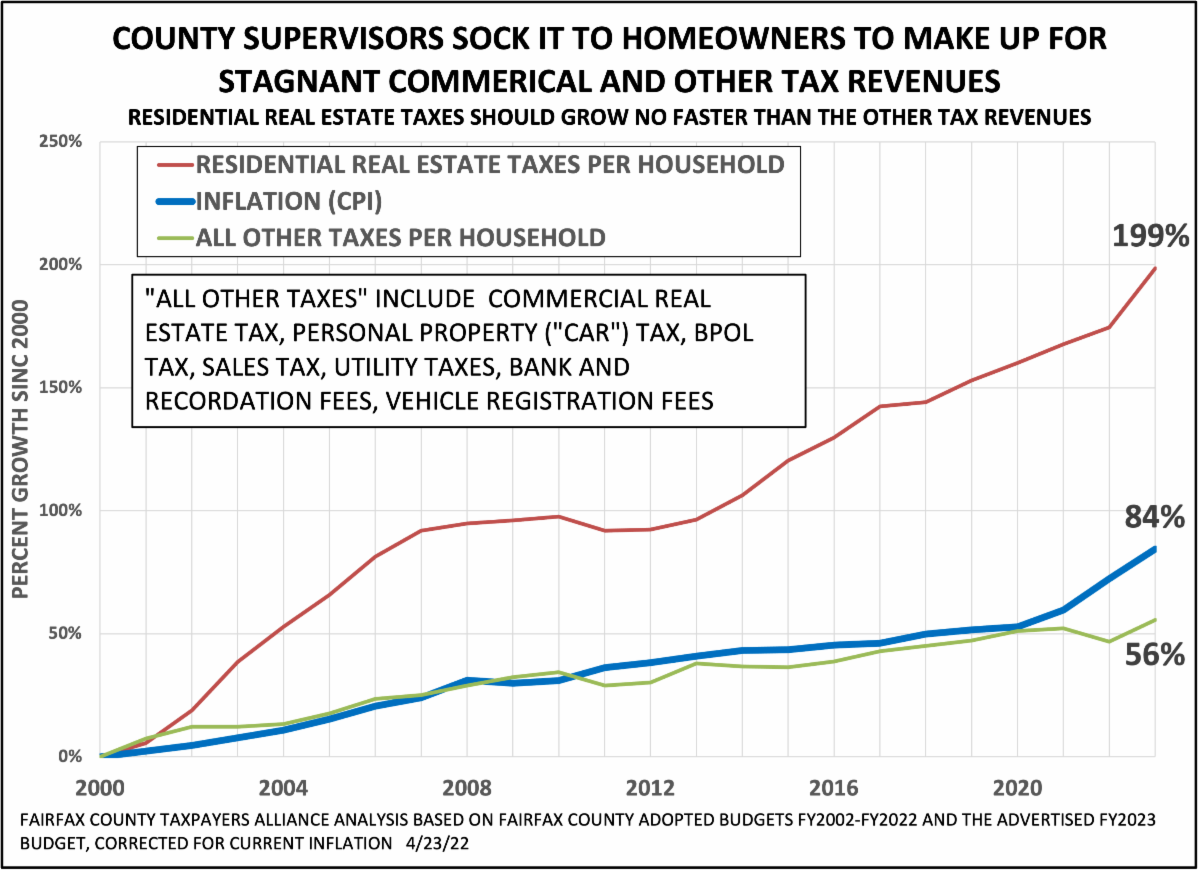

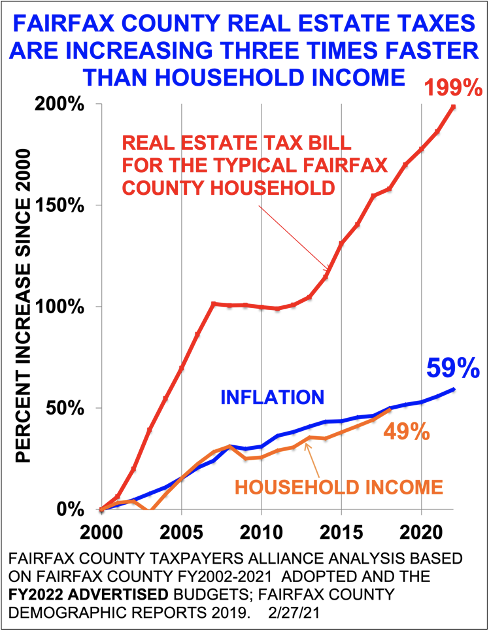

For the past two decades the average raises for county and school employees have been well above inflation. To pay for those raises, you've had to increase household real estate taxes faster than inflation. That's because your other revenue sources are stagnant. Commercial real estate taxes, the car tax, the BPOL tax, utility taxes, and sales taxes collected per household have barely kept up with inflation.

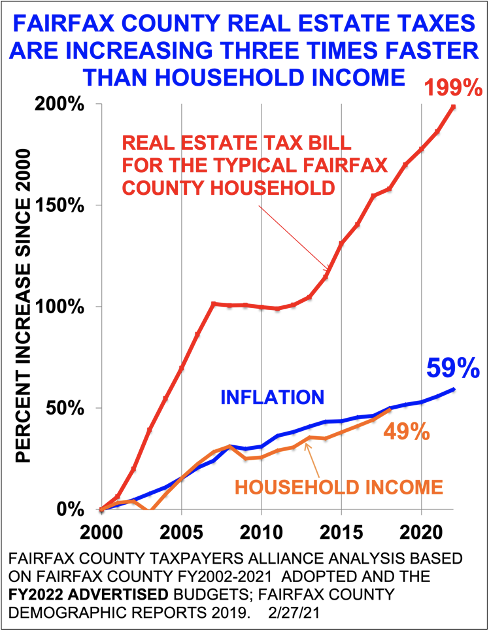

|

|

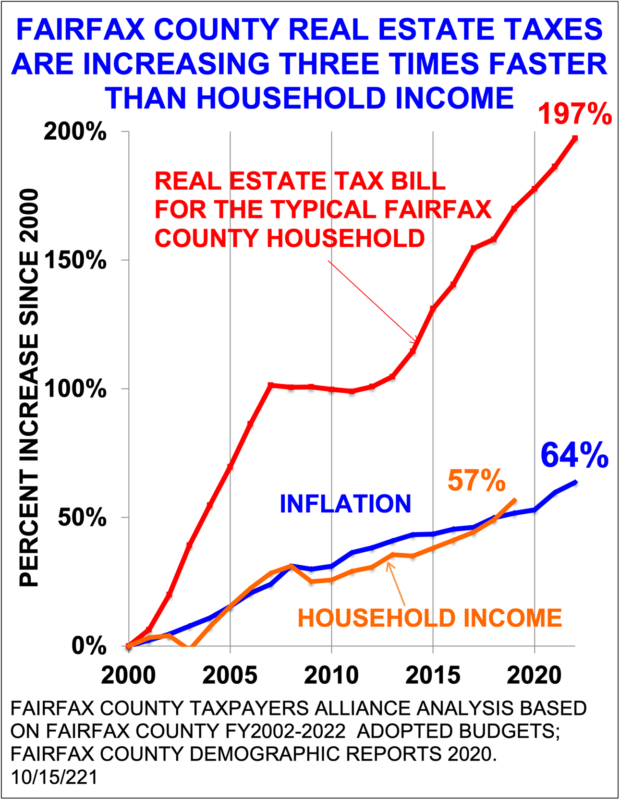

So, the only way you’ve been able to grant raises above inflation has been to sock it to the homeowners. For two decades you've increased homeowner real estate taxes about three times faster than household income.

You should be concerned. In FY2000, real estate tax revenues were only half of the county's income. But because all your other revenue sources are stagnant and because of your soaring residential real estate tax hikes, real estate taxes are now two-thirds of the county's income. You should see red flags.

If 37,000 county and school employees want raises that are above inflation, then then schools and county administrators should produce a workforce and a business climate that attracts and retains good businesses, increases personal wealth, and drives up tax revenues due to increased prosperity and not tax-rate increases.

The numbers say that hasn't happened in 20 years. Until it starts happening there is no justification for increasing residential tax revenues any faster than your other, stagnant, revenue sources.

As far as the Fairfax County Taxpayers Alliance is concerned, if the real estate tax rate is reduced by only 8, or 5, or 2 cents we will do our best to inform the voters that the incumbent supervisors enacted a tax hike.

Thank you.

Fairfax County Taxpayers Alliance is fighting for you!

Thanks for your support.

FCTA.org

FCTA's MONTHLY MESSAGE - March 2022

-- by Arthur Purves, FCTA President, 03/24/2022

"Reduce the Fairfax County Real Estate Tax Rate by 10 Cents"

- Note: Also posted on Bacon's Rebellion, The Bull Elephant, Fairfax County Times, and Sun Gazette.

If you live in Fairfax County and are over 50, you may have received from the county a 5-page 120-question survey to "... inform the county's ... Future Aging Plan". Here's the Fairfax County Taxpayers Alliance Future Aging Plan: Stop taxing us out of our homes.

|

|

For 20 years, the county supervisors have been increasing real estate taxes three times faster than household income. Real estate taxes are the supervisors' "Unaffordable Housing Program". The supervisors do have an "Affordable Housing Program", but with a waiting list so long that they're afraid to disclose it. Their Unaffordable Housing Program, however, has no waiting list: Homeowners get a tax hike July 28.

Assessments increased almost 10%. Everyone thinks that because assessments increased real estate taxes have to increase. This is false. The supervisors can prevent a tax hike by lowering the tax rate 10 cents. However, if they keep the rate unchanged, they get an extra $250 million. That's a quarter of billion dollars.

The supervisors want that money to give 37,000 county and school employees 6% and 7% raises, because of "recruitment and retention issues". For the past two decades the average raises for all county and school employees have been higher than inflation. Most employees would probably lose pay and benefits if they went to the private sector.

Except for police, the supervisors have provided no data about retention. What's the impact of mask and vaccine mandates? Administrivia? Or in the schools, student behavior? What's the impact of the anti-police rhetoric?

What do our taxes buy us?

A county administration that cannot attract business: commercial real estate tax revenues are stagnant.

A school system that, because of its flawed reading and arithmetic curriculum, provides no upward mobility for low-income children and mediocre achievement for whites.

A school system that uses history to attack the Constitution. As Governor Youngkin has repeatedly said, we need to teach honest history. But the goal of CRT is to dissolve the Senate, end the electoral college, and become a pure democracy. Pure democracy leads to tyranny. Vladimir Putin was elected president by a 71% majority. Hitler and Mussolini's parties won popular elections. Is that what we want from our taxes?

To prevent a tax increase the supervisors can lower the real estate rate by 10 cents. We predict they'll lower it by only 5 cents.

The supervisors have provided no evidence to back up their claim that recruitment and retention justify a quarter of a billion dollars of raises. Until they do, the Taxpayers Alliance recommends that the supervisors lower the tax rate 10 cents.

Also, union contributions to supervisor political campaigns are a conflict of interest, as unions sit on both sides of the bargaining table. We therefore recommend an end to union contributions to supervisor political campaigns.

Fairfax County Taxpayers Alliance is fighting for you!

Thanks for your support.

FCTA.org

FCTA's MONTHLY MESSAGE - January 2022

-- by Arthur Purves, FCTA President, 01/08/2022

A Taste of Tyranny - Testimony to the Fx Co Delegation to the Va General Assembly

- Note: The first Saturday of every January, the nine state senators and 17 delegates from Fairfax County hold a public hearing at the Fairfax County Government Center. Speakers have three minutes. This is the testimony given by Fairfax County Taxpayers Alliance president, Arthur Purves. It's been posted on Bacon's Rebellion and The Bull Elephant.

Thank you for holding this hearing. I have five topics:

First, it was 19 degrees this morning, and we just had a 20-hour, 50-mile shutdown on I-95 due to snow and ice. You should claim victory in your war against global warming, withdraw from the Regional Greenhouse Gas Initiative and repeal the Virginia Clean Energy Act, which drives up the cost of living and replaces reliable with unreliable energy. Solar panel production is not clean.

Why does Germany, a leader in clean energy, need a new natural gas pipeline?

The evidence for a climate change crisis is sketchy. For example, when I asked an employee who had worked at a ski resort for 32 years if the ski season had been shortened, the answer was no. For another example, Bangladesh flooding is the result of silt runoff due to deforestation, not rising sea levels.

Second, for two decades, Fairfax County real estate taxes have been increasing three times faster than household income. It is the county's "unaffordable housing" program. The tax hikes are driven by employee compensation. This year the supervisors have floated a 9 percent real estate tax hike so employees can have 6 percent raises. Unions donated $100,000 to Fairfax County Chairman's 2019 election campaign. To end this conflict of interest, we ask you to ban union contributions to local election campaigns.

Third, regarding CRT, public schools are a leading cause of poverty and racial inequality. They provide no upward mobility. The most important years are 1st and 2nd grades where reading and math facts are taught. However, by third grade, Blacks and Latinos are behind whites and Asians and never catch up. The reason is that schools teach "whole word" instead of intensive phonics and ignore arithmetic drill. The students who succeed are the ones who get phonics and math drill outside of school. Hence, the public-school curriculum advantages whites and Asians and disadvantages Blacks and Latinos. Thus, public schools fit the CRT definition of "systemic racism". More money won't fix public schools; competition will.

Fourth, families are crucial to student success. Edmund Burke said, "Liberty does not exist in the absence of morality." The same can be said of successful families. But in literature and Family Life Education, schools teach that morality is optional and unexpected. The destruction of families is government's growth engine.

Fifth, Edmund Burke also said, "The essence of tyranny is the enforcement of stupid laws." COVID lockdowns, school closures, mask mandates, mandates for experimental, misnamed vaccines, and the banning of low-risk, low-cost cures such as ivermectin and hydroxychloroquine (HCQ) come to mind.

By giving Virginians a taste of tyranny, you may have awakened them.

Fairfax County Taxpayers Alliance is fighting for you!

Thanks for your support.

FCTA.org

FCTA's MONTHLY MESSAGE - October 2021

-- by Arthur Purves, FCTA President, 09/28/2021

Democrat Bunkum about Youngkin

In this fall's Virginia gubernatorial campaign, Virginia Democrats are citing "a new independent study" to attack Republican gubernatorial candidate Glenn Youngkin, when Democrat policies themselves merit scrutiny. The Virginia Democrats web page does not cite the source of the Youngkin study but does link to the the website of the Virginia Education Association (VEA), whose political action committee has endorsed the Democrat candidate. The VEA page describes a study about "... Mr. Youngkin's proposal to eliminate the personal income tax ..." but does not link to an actual study. To request it, you must contact VEA Communications.

Try it. The reply was, "This study is being reserved for VEA members and members of the media."

What are the Democrats and the "independent" Virginia Education Association trying to hide? Perhaps it is that Mr. Youngkin never proposed to eliminate the personal income tax. According to PolitiFact:

-

Seeking the GOP nomination in April, Youngkin said he was focused "on not just getting our income tax down, but how we can, in fact, eliminate it." Although that may have stirred some Republicans, Youngkin stopped short of saying he would abolish the tax. He said he was looking into it with a conservative economist.

Four months later, Youngkin says he still wants to cut the income tax but has determined it's infeasible to eliminate it. That's a significant change in position, but he left himself some leeway.

The VEA page also cites cataclysmic numbers, for example 43,000 fewer educator jobs, from another study, by Virginia Excels, which is based on the same falsehood.

Now, consider Democrat proposals.

For education, instead of returning last year's record $2.6 billion budget surplus to taxpayers, they will increase public school spending annually by $2 billion. They do not promise to raise overall or minority achievement. That requires elementary school curricula changes that they oppose, namely intensive phonics instead of "Balanced Literacy" and arithmetic drill instead of reliance on hand calculators.

For the economy, their promise of good jobs for Black and Brown communities will fail, as it has for past decades, as long as Virginia public schools fail to raise minority achievement. Mandatory sick leave and raising the minimum wage jeopardize small businesses and reduce entry-level jobs. Think kiosks at McDonalds.

For COVID recovery, they will help Black and Brown-owned businesses, which closed at disproportionate rates during the lockdown, by again raising the minimum wage and by mandating paid sick, family, and medical leave! Can small businesses afford mandates?

For healthcare, they will expand Medicaid, which subsidizes poverty rather than ending it, and still allows hospitals to charge exorbitant rates elsewhere to make up for Medicaid underpayments.

For gun violence, they will continue complicating gun laws so law-abiding citizens become inadvertent felons, while Democrats ignore family breakdown, which is the source of most gun violence.

For energy, Democrats will tear down all natural gas power plants and ban gasoline cars, driving up energy costs and causing solar and wind-related brownouts to avoid climate disasters that are predicted but don't occur. Imagine your electric car's battery running out in a traffic jam.

For higher education, they will attempt to teach in community colleges what they failed to teach in grades K-12.

Their affordable housing plans reduce the housing supply by imposing mandates and restrictions on landlords. Affordable housing programs do not meet a fraction of the demand.

For nutrition, the government will furnish more meals. Remember when families used to cook their own meals?

For women's rights, they ignore that Virginia already has 17,000 abortions a year, and that half of the babies aborted are female. The United States birth rate is now below the replacement level. Is that what Democrats want?

For Black Virginians, Democrats force Black children -- and all children -- to attend public schools that cannot even teach reading and writing, thereby trapping children in poverty.

For seniors, the Democrats will drive up taxes that erode retirement incomes to fund programs that subsidize problems instead of solving them.

For COVID, the Democrats will "incentivize" ($14,000 fines per employee?) businesses to mandate the COVID vaccine even though the inventor of mRNA warns against universal vaccination (will result in a vaccine-resistant variant) and says that only those at high risk should be vaccinated.

Democrats attack Youngkin for a proposal that Youngkin never made and base their attack on a secret "independent" study that wasn't independent. Meanwhile Democrat proposals are the same socialist solutions Democrats have promoted for a century. They drive up taxes, trap the poor in poverty, subsidize failed programs, erode freedom, and ignore individual responsibility, the power of free markets, and the critical role of families.

-

Note: This article was reprinted at Bacon's Rebellion and The Bull Elephant.

Fairfax County Taxpayers Alliance is fighting for you!

Thanks for your support.

FCTA.org

FCTA's MONTHLY MESSAGE - September 2021

-- by Arthur Purves, FCTA President, 09/24/2021

Return Virginia's Surplus, Don't Reward Schools that Don't Teach

Virginia ended Fiscal Year (FY) 2021 with a record-breaking budget surplus of $2.6 billion. (Virginia's budget year, or fiscal year, is from July 1 to June 30.) Virginia Governor Ralph Northam stated that the surplus was due to Virginia's great business climate, pointing out that CNBC ranked Virginia as the #1 state for being business friendly. Not everyone agrees with CNBC. The Virginia Industry Foundation last November ranked Virginia as #11.

$800 million in tax hikes.

Also, Governor Northam did not acknowledge that perhaps $800 million of the

surplus is from two recent tax hikes. One is the internet sales tax, which

started July 2019. The other is Virginia's failure to increase its income

tax standard deductions to conform to the federal standard deductions.

Currently the Virginia standard deduction for single and married filers is $4,500 and $9,000 compared to the 2021 federal deductions of $12,550 and $25,100. Many filers have itemized deductions that are less than the federal standard deduction but greater than the Virginia standard deduction. They opt for the federal standard deduction to save on federal taxes but are then forced by Virginia to use the Virginia standard deduction on their state return. They then pay more for their Virginia tax than they did with itemized deductions.

|

|

In 2019, the Virginia Department of Taxation estimated that the new internet sales tax would increase Virginia revenues by $175 million in FY2021. The Tax Foundation estimated that the lack of conformity between Virginia and federal standard deductions would increase Virginia revenues by $600 million.

Governor Northam's press release on the FY2021 surplus did not specify how much of the surplus came from these two tax increases.

Republican gubernatorial candidate Glenn Youngkin has promised to double the Virginia standard deductions and return about $1 billion of the surplus in the form of one-time checks of $300 to single filers and $600 to joint filers.

Extra billions for public schools.

However, whenever Republicans propose cutting taxes, Democrats often counter

by saying that the money is needed for the "underfunded" public schools.

For example, when State Senator Janet Howell, D-Fairfax, announced her run for re-election in 2019, she stated, "I am outraged that despite loud breast beating about the importance of education, we do very little to fund it."

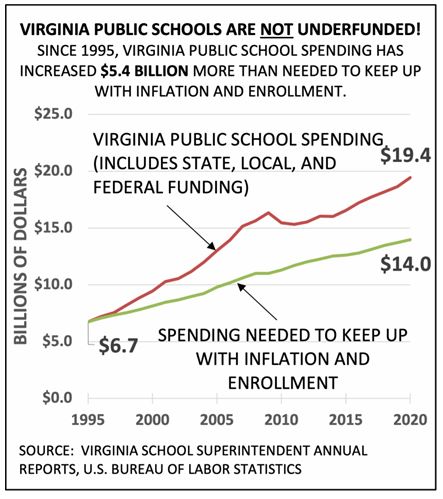

Senator Howell was first elected in 1995. Since then, Virginia spending on public schools has increased $5.4 billion more than needed to keep up with enrollment and inflation. This includes state, local, and federal funding.

Senator Howell, by virtue of the Democrats winning the majority in the state senate, is now chairman of the powerful Senate Finance Committee. It is sobering that the Senate Finance Committee chairman considers an extra $5.4 billion "very little".

|

|

Low student achievement.

What is student achievement with the extra billions? Not good.

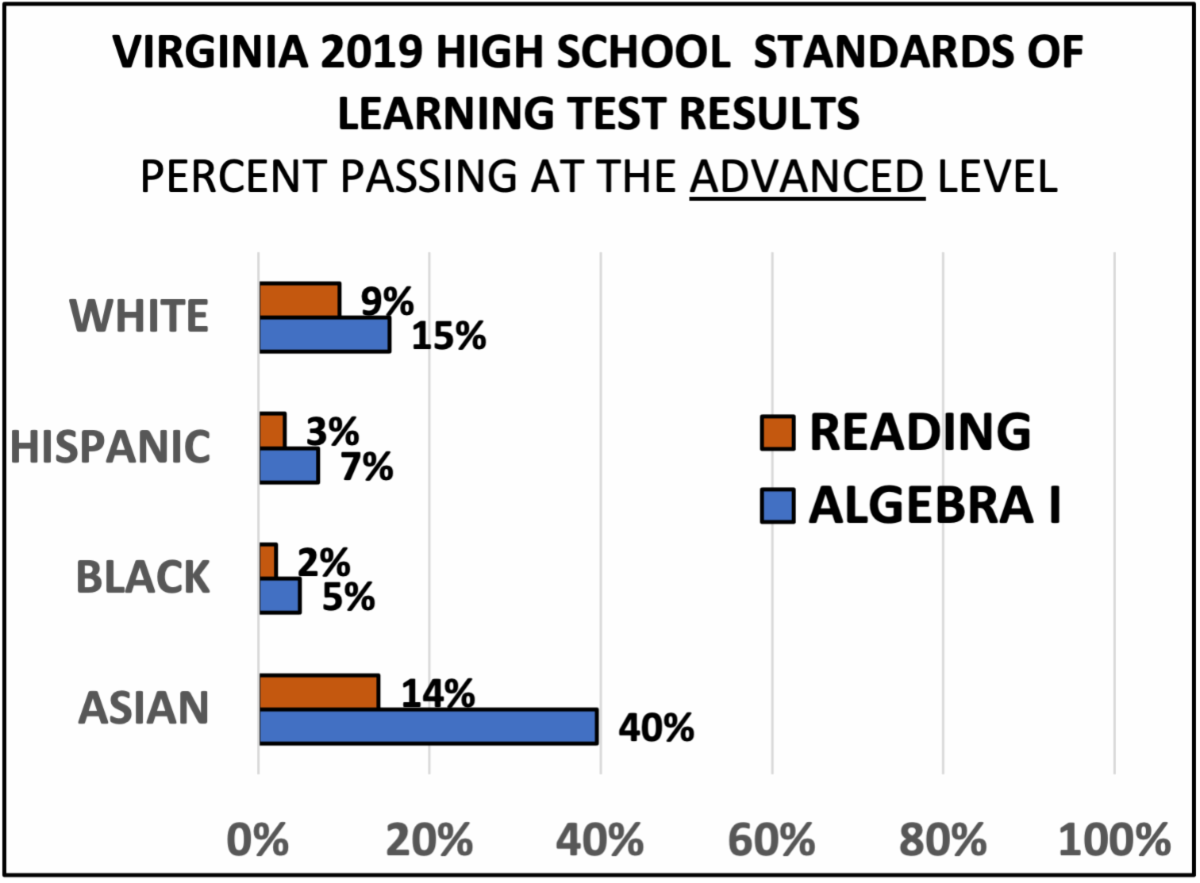

Every year Virginia administers Standards of Learning (SOL) tests statewide, including high school tests for reading and Algebra I. The SOL tests have two passing thresholds, "Pass Proficient" and "Pass Advanced".

"Pass Proficient" is a misnomer; "Pass Barely Proficient" would be more appropriate as it corresponds to D-level work, or just above failing. "Pass Advanced" is a better indicator of college and career readiness.

Statewide only 14% of Asians read at the Advanced level; and Whites, Blacks, and Hispanics do worse.

Statewide, 40% of Asians passed Algebra I at the Advanced level, while whites, Blacks, and Hispanics were at 15% or less.

Public schools' flawed curriculum.

The extra billions of dollars did not raise achievement. The reason is

that public schools do not teach reading (they use "whole word" instead of

intensive phonics for reading instruction) nor math (no math drill), little

history (displaced by social studies) nor morals (unconstitutional).

The flawed reading and math instruction results in many children being unable to read and do math facts by 3rd grade, and they never catch up. Teachers are victims too, being forced to use bad curricula and deal with students who are frustrated because they're not learning.

More taxes for schools that cannot teach reading and math are dollars wasted.

Public schools provide no upward mobility for low-income children. If you are poor in kindergarten, you will be poor as an adult.

Critical Race Theory.

Another problem is Critical Race Theory, now called "Culturally Responsive

Education". Although what little history public schools teach ignores

travesties in American history, Critical Race Theory tells students what

America has done wrong and nothing about what America has done right.

This biases students against the Constitution and towards socialism.

Are students taught that Hitler was a socialist and that NAZI stands for

National Socialist German Workers Party? It is ironic that public schools,

which virtue signal about systemic racism, are perhaps the major reason

why minorities have no upward mobility, due to the schools' flawed

curricula.

End state control of public schools.

What is to be done? First there should be no increase in public school

funding until the curricula are fixed. However, state and local school

boards have embraced bad curricula for nearly a century and show no signs

of relenting.

So, second, end state control of public schools and let local school boards run their districts. Virginians pay the state Department of Education $300 million annually to administer mediocrity statewide. Maybe local school districts would compete to attract good students. Ending state control of public schools would require amending the Virginia constitution, which states in Article VIII that the General Assembly "... shall seek to ensure that an educational program of high quality is established ..." The General Assembly has shown it is incapable of doing that.

School choice.

Third, as Glenn Youngkin has advocated but Terry McAuliffe opposes, enact

school choice. One option is for school districts to give a voucher equal

to the per-student cost for every child that leaves public school for

private or home schooling. Another option is to replicate West Virginia's

Hope Scholarship, which allows parents to spend the state portion of school

funding for private schools or home tutoring.

In any case, we need to stop increasing spending for public schools that perpetuate mediocrity and poverty and turn children against our country. Both students and teachers deserve to teach in schools where children really learn, teachers really teach, and students are not turned against a country that is (was?) so free and prosperous that the rest of the world wants to migrate here.

-

Note: This article was reprinted at Bacon's Rebellion.

Fairfax County Taxpayers Alliance is fighting for you!

Thanks for your support.

FCTA.org

FCTA's MONTHLY MESSAGE - July 2021

-- by David Swink, 07/29/2021

The Left's Critical 3-M Theories

It's summertime and the state and local pols are safely unbusy, so this article will reflect on the big freedom-robbing and indoctrination issues being pushed nationally by the Left and their media enablers. I refer to these as the 3-M's of Critical Theory -- 1. Critical "Melting" Theory (aka 'Global Warming' or 'Climate Change'); 2. Critical "Mask" Theory (part of the whole Covid fear-stoking effort for political control); and 3. Critical "Marxist" Theory (aka 'Critical Race Theory') -- stated in the order of mass public awareness:

Critical "Melting" Theory:

While CO2 makes up about 0.03% of the earth's atmosphere (Nitrogen 78%,

Oxygen 21%, Argon 0.93%) and is essential to all plant life, so-called

"environmentalists" have been attributing man's production of this very

minor greenhouse gas to the earth's doom-by-warming for the last 35 years,

with at least two RIP deadlines long past. No empirical science is involved,

just wildly inaccurate computer models. Meanwhile, actual worldwide warming

measurements have not

increased since 1998.

So what is the rationale for this effort to eliminate the use of fossil fuels? The answer: Control! The Left hates the freedom of mobility that diesel- and gas-driven cars and trucks provide (themselves exempted, of course). They would ideally like you confined to expensive public transportation. Alternatively, they want you to buy taxpayer-subsidized electric vehicles, which currently leave you dependent on mileage-limited lithium-ion batteries. Ironically, these same EV technologies cost the earth dearly in the mining of rare-earth and other precious metals (80% supplied by China) and are extremely damaging to the environment at life-cycle end, as they are very difficult and expensive to recycle. (ref: Truth About EVs)

Critical "Mask" Theory:

The Wuhan Covid-19 virus in early 2020 provided Leftists with a golden

opportunity to induce the citizenry to give up their freedom of association

("temporarily", of course). The President properly passed off enforcement

of any public health measures to the states, with a recommended two-week

period until the lethality of the virus was determined. But the pols in

many states and localities took this as a cue to grab and hold on to power

while their allies in the media kept their audiences in fear.

The CDC early on determined that Covid was about as lethal as the seasonal flu, with only a 0.26% mortality rate for those contracting the disease -- primarily the elderly and infirm. Children were considered virtually immune to Covid and were not vectors for transmission. So locking down the entire population was not necessary. Nevertheless, state and local pols instituted drastic lockdown, masking, and social distancing requirements; churches were ordered closed; schools were shut down for in-person learning for most of the 2021 school year.

Science also indicated early on that cheap medications like Hydroxychloroquine or Ivermectin were quite effective when applied in early treatment of patients experiencing Covid symptoms, thus allowing the patient to develop natural antibodies to future Covid infections. But how could Big Pharma make any money that way?! So the push was to crash-produce still-experimental vaccines at great taxpayer expense, vaccines which can cause serious side effects unlike HCQ or Ivermectin. And it turns out that those vaccines do not help your body produce the necessary antibodies to protect against Covid "variants", while naturally recovering from Covid likely does.

Still the drumbeat goes on for masking, mandatory Covid vaccination, and "vaccine passports". This has nothing to do with public health, but is an overt attempt to get people to cede their freedom to the ruling class. American pols admire the Orwellian "social credit scores" now required of the Chinese citizenry to track every facet of a person's life. Once again: Control!

Critical "Marxist" Theory:

The Left's "Melting" and "Mask" Theories would not be accepted by a public

properly educated in the nation's school systems. For some decades now,

public education has been in decline, with students being instructed in WHAT

to think, not in HOW to think. This dumbing down has accelerated in recent

months with the advent of "Critical Race Theory" -- a Marxist concept

Americanized with "race warfare" substituting for "class warfare".

Traditional "race hustlers" like Jesse Jackson and Al Sharpton directed their ire at society at large. Now Ibram Kendi is practicing the newest form of race hustle on America's students in our schools. Some schools were already promoting that discredited "Hannah's Hyphenated History" variant called the "1619 Project" (more accurately dubbed the "1917 Project"). Kendi's "Stamped: Racism, Antiracism, and You" is heavily promoted within Fairfax County, and you can read the book and or its critique and judge for yourself, located here: fcta.org/books/.

Ibram Kendi's STAMPED is remarkable only in that this modern-day race hustler has managed to promote it in many public (and private) "But-We-Don't-Teach-Critical-Race-Theory" school systems nationwide. As with other Woke/Marxist screeds, it's purpose is to dredge up unsavory items from the nation's past for the purpose of pitting [racial] classes against one another -- in the Leninist model. Kendi clearly states his purpose thusly: "I hope it's clear how the construct of race has always been used to keep and gain power, whether financially or politically." -- precisely what he's trying to perpetuate.

Critical "Thinking" and Critical "Information" -- Missing In Action:

So now you get the picture of the Left's "Critical 3-M Theories". Having

gained control of our institutions -- Schools, the Universities, Media,

Big Tech, Corporate CEOs, and Government agencies including FBI and even

DOD -- the Left is now indoctrinating our kids to hate the country, and

using Big Tech and the MainStream Media to promote misinformation and

outright disinformation on important issues such as the Global Warming hype

and the Covid Scamdemic.

Fairfax County Taxpayers Alliance is fighting for you!

Thanks for your support.

FCTA.org

FCTA's MONTHLY MESSAGE - June 2021

-- by Arthur Purves, FCTA President, 06/24/2021

(also posted at Bacon's Rebellion)

Governor Northam's Hidden 40% Gasoline Tax Hike

Did you know that last year Virginia's tax on gasoline increased 5 cents per gallon, on July 1, 2020, from 24.4 cents to 29.4 cents?

Did you know that this year Virginia's tax on gasoline is increasing again, by another 5 cents per gallon on July 1, 2021, to 34.4 cents? That is a 40% increase in one year, costing the average motorist about $50 per year.

Also, starting next year the Virginia gasoline tax will automatically increase with inflation every July 1st.

Did you know that in addition to the Virginia gasoline tax, there is a federal gasoline tax of 18.4 cents?

Therefore, the total gasoline tax at Virginia pumps will have increased from 42.8 cents in 2019 to 52.8 cents this year.

You won’t find these numbers in press reports because the For example, a March 8, 2020, Washington Post article, "Virginia

General Assembly approves higher gas tax ..." quoted Virginia officials

as saying that the gas tax before last year's increase was 16.2 cents.

It wasn't; it was 24.4 cents. The 16.2 cents is what the retailer pays the

state. In addition, the wholesaler pays another 7.6 cents per gallon to the

state. On top of that there is a 0.6 cent tax per gallon for tank storage.

The Department of Motor Vehicles (DMV) collects gasoline taxes and is

responsible for reporting them. A June 5, 2020, DMV press release,

"New Law Reduces Vehicle Registration Fees for Virginians ..." does mention

"increasing the statewide gas tax by five cents this year and next."

The press release however emphasizes a $10 reduction in vehicle registration

fees, while admitting to a new "highway use fee" of $19 for fuel-efficient

cars.

Elsewhere the DMV website does mention the 2019 retailer 16.2 cent gas tax,

that it increased to 21.2 cents last year, and that it increases to 26.2 this

year, but try to find it. The 0.6 cent storage tank fee is also shown, but

with a typo: It's shown as "0.006 cents." It should be 0.6 cents or $0.006.

The wholesaler’s 7.6 cent per gallon tax is on a separate DMV page.

Nowhere does the DMV state that the total Virginia gasoline tax was

increasing from 24.4 cents to 34.4 cents.

Nowhere does the DMV website mention that with the federal gas tax,

the total gasoline tax at Virginia pumps will be 52.8 cents.

The gasoline tax hikes along with increases in hotel taxes and real estate

transfer taxes plus the new "highway use fee" were enacted by Patrons of HB1414 include Fairfax County Delegates Eileen Filler-Corn,

"Rip" Sullivan, Jr., Vivian Watts, and Kathleen Murphy.

Patrons of the identical senate version, Senate Bill 890 (SB890), include

Fairfax County Senators Richard Saslaw, Jennifer Boysko, and

Barbara Favola. In the Washington Post article, a Northam spokeswoman said that

HB1414 is a "once-in-a-generation" package. Not so. In 2019, HB2718

imposed the 7.6 cent wholesale gas tax on the I-81 corridor. Add to that

the new tolls on I-66. In 2013, HB 2313, another transportation bill,

raised the Fairfax County sales tax from 5 to 6 cents, a 20% increase, and

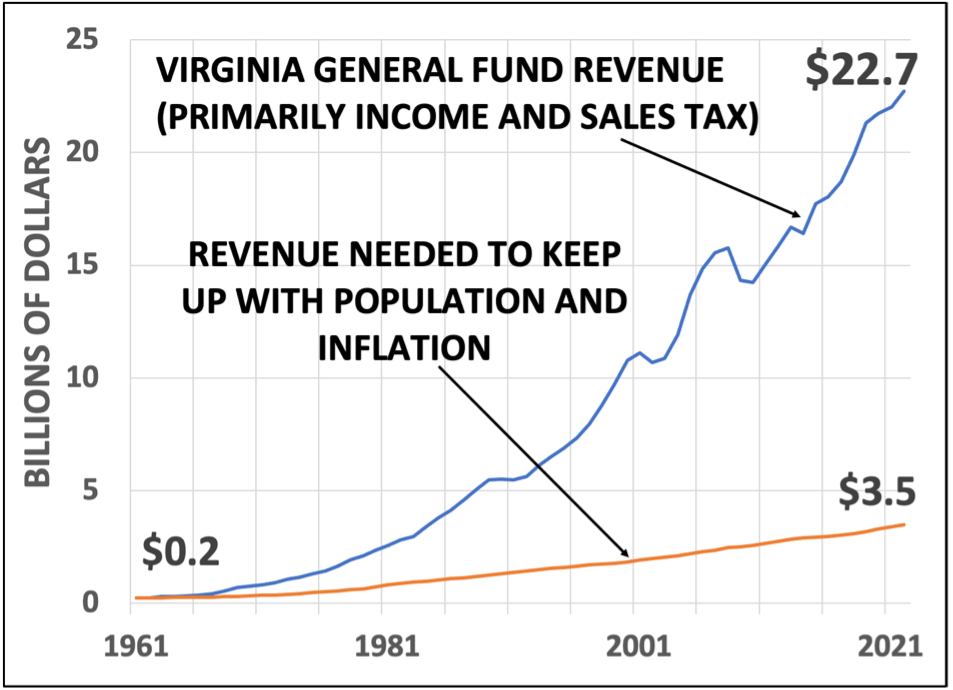

increased the auto sales tax from 3% to 4.15%. Perhaps Virginia's fastest growing revenue is "General Fund" revenue,

which is primarily income taxes and the portion of state sales taxes not

earmarked for transportation. Earmarked taxes go into a "Non-General Fund."

Since 1961, General Fund revenues, which are mainly spent on education

and welfare and are off-limits to transportation, have grown 7 times

faster than Virginia population and inflation.

If transportation had been allowed to compete against bloated education

and welfare budgets for soaring General Fund revenues, the repeated

transportation tax hikes would not have been necessary.

Fairfax County Taxpayers Alliance is fighting for you! -- by Arthur Purves, FCTA President, 04/30/2021

Learning or Indoctrination in our Schools? As the county anxiously awaits the return of full-time in-person school,

one might ask, "What will the students learn in our $3 billion school

system?"

They will not learn reading or arithmetic, at least not in school. Decades

ago, Fairfax County Public Schools (FCPS) abandoned phonics, without

which you cannot learn reading, and it abandoned arithmetic drill,

without which you cannot do math.

However, it appears that students will learn Critical Race Theory.

Last August, FCPS paid $20,000 for Dr. Ibram X. Kendi to give a 1-hour

online presentation entitled "Cultivating an Anti-Racist School Community"

to an estimated audience of 1,500 FCPS staff members.

To learn what Dr. Kendi said, the Taxpayers Alliance submitted a Freedom

of Information Act (FOIA) request for the transcript of the presentation.

The reply was that while there is no transcript, there is a recording.

However, the school superintendent agreed to a contract stipulating that

the recording could not be released to the public. The recording is

"confidential."

The Taxpayers Alliance then submitted another FOIA request "to see all

Critical Race Theory materials being taught to students."

The FCPS FOIA office sent this reply:

Please be advised, it is unclear what specific records you are

requesting. VFOIA requires that requests for public records be made

with reasonable specificity. Va. Code § 2.2-3704(B). If you wish to revise

the scope of your request, then please provide additional information on

what specific records you seek as Critical Race Theory is not a category

that FCPS uses to define instructional material.

Additionally, please be advised that FCPS has over 190 schools and course

materials are not maintained in a central location. If you wish to revise

the scope of your request, then please provide additional information on

what specific records you seek. You may wish to clarify the scope of your

request by identifying specific schools, course names or subjects, and/or

teacher names.

To this, the Taxpayers Alliance replied with:

Pursuant to the need, specified in your 4/26/21 email..., for a more

specific request, may [we] please see [the] content of the Social Emotional

Learning lessons being taught at Thomas Jefferson High School, including

the lesson taught on March 19, 2021?

As this is written, we received the May 19 lesson slides. The lesson centers

on the movie, "13th", about incarceration of African Americans. The irony

is that the "school-to-prison pipeline" begins with public school failure

to teach reading and arithmetic by 3rd grade, which the lesson ignores.

Will public schools acknowledge their role in the disproportionate

incarceration of African Americans?

On a different matter, the Taxpayers Alliance submitted another FOIA request

asking: "During the COVID lockdown, how many FCPS employees were paid

for not working and how much was spent paying employees who were not

working?"

The FCPS FOIA office sent this reply:

Please be advised that it is unclear what specific records you are

requesting. VFOIA requires that requests for public records be made

with reasonable specificity. Va. Code Ann. § 2.2-3704(B). If you wish to

revise the scope of your request, then please provide additional information

on what specific records you seek. For example, do you seek records related

to employee leave (Emergency Paid Sick Leave and Emergency Family Medical

Leave, Emergency Administrative Leave)? If so, then please let us know

and identify a date range for your request. There are new FOIA payment requirements. Previously, we would be notified

in advance of a cost. Now if the cost is $200 or less, the FOIA office will

supply the response with “\"a bill due on receipt." In other words, we

may be charged, without advance notice, up to $200 for a FOIA request.

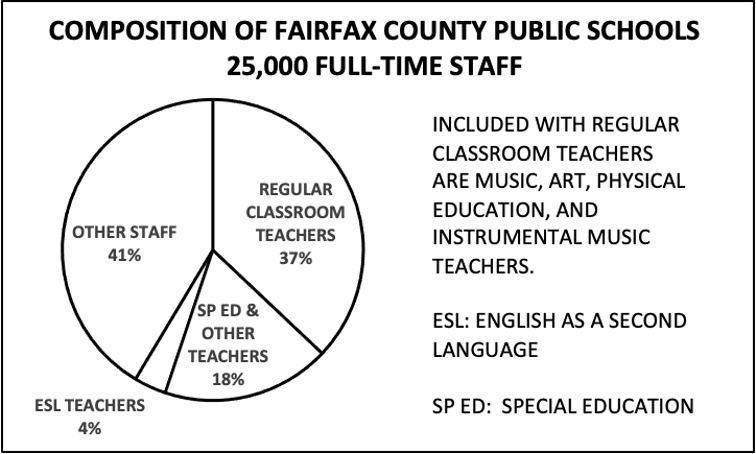

CALL TO ACTION! BTW: We are often asked what percentage of FCPS staff is regular

classroom teachers. As this chart shows, it is 37%. There is

one staff member for every 8 students.

Fairfax County Taxpayers Alliance is fighting for you! -- by Arthur Purves, FCTA President, 03/27/2021

County chairman covering up a 4% real estate tax hike On March 9, the Fairfax County Board of Supervisors, which is deciding on

next year's county budget, advertised a 4.25% real estate tax hike,

which would cost the average homeowner $293. This continues a two-decade

trend where the supervisors have increased real estate taxes three times

faster than homeowner income, which has barely kept up with inflation.

The average homeowner real estate tax next year would be $7200. If real

estate taxes had increased at the same pace as inflation since 2000,

the average tax would be $3800. The $293 increase would be the largest real estate tax hike in five

years. However, you would not know it from reading the county chairman's

newsletter.

It is easy for the supervisors to mislead taxpayers about real estate taxes.

In his March 9, 2021 newsletter, county chairman Jeffrey McKay (D-At-Large)

stated that the advertised real estate tax rate for next year is $1.15 per

$100 of your home’s assessed value, the same as this year's rate. While he

acknowledged "... that many residents' assessments are on the rise ...",

he did not acknowledge that the average increase in residential

assessments is 4.25%. While many homeowners will have tax hikes of 4%

or more and others less depending on their individual assessments, most will

have a tax increase, and the average increase will be 4.25%

By comparison, the cost-of-living increase in Social Security benefits

this year is 1.3%. The county's $293 advertised real estate tax increase

is greater than the average 2021 Social Security increase, which is $240.

Also, Chairman McKay neglected to say that the advertised real estate tax

rate is just over $1.18, not $1.15. This is because, starting in 2010,

the supervisors added to your real estate tax bill a new stormwater tax,

which is also based on your assessment. The stormwater rate is an additional

3 ¼ cents.

A Taxpayers Alliance member emailed us that the Mason District supervisor,

at her budget town hall, said that real estate taxes are increasing due to

higher assessments. Our member forced the supervisor to admit that the

supervisors could prevent a tax increase by lowering the real estate rate,

from $1.15 to $1.10, which would cancel out the assessment increase.

The supervisor then told our member to email her suggestions on what to cut.

Here's a suggestion. Preventing a tax increase by lowering the rate to

$1.10 would reduce next year's Fairfax County revenues by $150 million.

Meanwhile, Note that Fairfax County has received $470 million in COVID relief

funds, primarily from the $2.2 billion CARES Act, passed in March 2020.

The county estimates that it will receive an additional $222 million from

the just-passed $1.9 billion American Rescue Plan.

Also, both the county and FCPS have not answered repeated requests from

the Taxpayers Alliance about how many employees were paid while not working

and how much that cost. To our knowledge, no county or school employees

lost jobs or pay due to the COVID lockdown, while their private-sector

counterparts did lose jobs, pay, and businesses. Last year, during the

lockdown, the supervisors imposed a 3% real estate tax hike and now they're

advertising a 4.25% tax hike during the second year of the lockdown.

If you oppose a real estate tax hike, please contact county chairman

Jeffrey McKay well before April 27, when the supervisors finalize

the budget. His phone is 703-324-2321, and he can be emailed at

chairman@fairfaxcounty.gov.

If you feel that it is unacceptable to pay the school system $149 million

for 9,000 students who have withdrawn from the system, please contact school

board chairman Ricardy Anderson at 571-423-1083.

Your phone calls can have an impact.

Fairfax County Taxpayers Alliance is fighting for you! -- by Arthur Purves, FCTA President, 02/16/2021

No taxation without education! Madam Chairman, Members of the Board, Mr. Superintendent:

My name is Arthur Purves. I address you as president of the Fairfax County

Taxpayers Alliance. We have three observations.

First, on September 3 of last year, we emailed the Office of Communications

to ask how many employees had gotten full pay while not working during

the COVID lockdown, and the cost. On September 11, we received a reply

that the answer would cost us $87.50. On September 22, without our agreeing

to the cost, we received another reply stating that our "questions do not

fall within the scope of FOIA" along with some woefully incomplete data.

Another email, on September 29, said we still owed the $87.50. Besides

being asked to pay for an answer we did not get, we were surprised that

the school board did not have the answer. Therefore, we have to estimate

the answer. Given that salaries cost $1.7 billion, a conservative

estimate that a quarter of that was spent on non-working employees

would result in a cost of $400 million, or 20% of the school transfer.

Also, we note that the proposed FY2022 budget asks for a $43 million

increase from the county even though enrollment has decreased by 9,000.

Second, this would not be an issue if schools were open. Fairfax County

reports COVID deaths by age group. As of today, 82% of the County's 776

COVID deaths (out of a population of 1.1 million) have been among ages 65 or

older. For ages 50-64, mortality is five hundredths of a percent; for

ages 18-49 it is six thousandths of a percent, and there have been no

deaths for ages 17 and under. The county does not publish ICU availability,

but statewide ICU utilization is 57%. Hospitals are not overcrowded.

What is not reported are the hardships imposed, especially on low-income

families, by the lockdown. It's fair to assume that those hardships

overwhelm the COVID risks for those under 65. Please open the schools.

Third, as we've been saying for a quarter of a century, it is within the

power of the school board to dramatically reduce racial inequality by

bringing back phonics-based reading instruction and arithmetic drill.

"One Fairfax" is a stunning admission that the school curricula,

especially in early elementary school, have failed to give equal opportunity

to low-income Blacks and Hispanics. "Whole word" instruction has a

century-long record of failure, while you haven't even tried phonics-based

reading instruction. Before the Civil War it was illegal to teach a Black

to read for fear that the ability to read would enable them to become

independent. To present words to children and expect them to memorize words

without being able to sound them out is not teaching reading. The cost

of not teaching reading is enormous, not only in terms of budgets for

remediation, welfare, and law enforcement, but in the human cost of

ruined lives. You can fix this!

We oppose taxation without education! Please open schools and really

teach reading.

Thank you.

Fairfax County Taxpayers Alliance is fighting for you! -- by Arthur Purves, FCTA President, 01/19/2021

Don't be misled about real estate tax hikes! On April 27, 2021, the ten-member Fairfax County Board of Supervisors will

vote on this year’s real estate taxes. When the supervisors raise real

estate taxes, as they have every year since 2012, beware that they befuddle

you by confusing the real estate tax with the real estate tax rate.

To counter that, here are some myths and facts about real estate taxes.

Remember, your real estate tax is the assessed value of your home times

the real estate tax rate. MYTH: My assessment increased. Therefore, my real estate tax has to

increase. MYTH: The supervisors did not increase the tax rate. Therefore,

my real estate tax will not increase. MYTH: The supervisors raised the real estate tax rate by 2%.

Therefore, my real estate tax will increase by only 2%. MYTH: The supervisors decreased the real estate rate by 2%.

Therefore, my real estate taxes will decrease also. MYTH: Since the real estate tax rate in 2020 was $1.15 per $100 of

assessed value of my home, my real estate tax bill was based on that

rate. MYTH: The supervisors raised the real estate tax rate by 3 cents.

That means my real estate tax increased by 3%. What to watch for: Since the start of the housing bubble in 2000, Fairfax County residential

real estate taxes have been increasing three times faster than household

income, which in turn has barely been keeping up with inflation.

Last year, real estate taxes increased 2.6% even though the real estate

tax rate remained flat. Don’t let the supervisors befuddle you again.

** Note: The above refers to calendar years (Jan 1 - Dec 31)

and not fiscal years (Jul 1 - Jun 30).

Fairfax County Taxpayers Alliance is fighting for you! -- by David Swink, 12/12/2020

Voting Machines Then and Now Regardless of the final outcome of the 2020 Presidential election, most

people outside the mainstream media and their Big Tech allies believe massive

election fraud occurred in important battleground states -- enough to change

the outcome of the election. Thus it is critically important to find out how

this was allowed to occur, and take steps to prevent it from reoccurring.

Back before 2000, mechanical machines and mechanical tabulation of votes were

common. Some states like Virginia used heavy lever-type voting machines,

where you pushed levers for your choices and the results were archived on

a paper tape or some other medium for tabulation. In other states like

Florida, a clipboard-sized device recorded voter selections on IBM-type

punch cards, which were then tabulated. Both types left a "paper trail"

that could be recounted easily.

In the early 2000s, many states including Virginia used PC-based electronic

voting machines whereby the voter selected his choices from a computer touch

screen and the tabulated results were recorded internally but without the

"paper trail". But with clever programming, it was found that choices could

be altered and never detected, and there was no way to go back and verify

the tabulated results.

So back to paper ballots. Optical Character Recognition (OCR) machines were

introduced to replace those touch-screen PCs. The new machines could be

programmed to read and interpret the black bubble marks made by the voter on

the front and back of a letter- or legal-sized paper ballot, save the ballot

in a bin within the machine, and tabulate the votes so entered. Thus a

literal "paper trail" was left behind in case a recount was required.

So what could go wrong!?

Well, it turns out that many of these machines were built with software that

allowed the machine to be nudged to favor certain selections at the expense

of others. This could be done in a way subtle enough not to draw suspicion.

So one party could be awarded 3/5 of a vote (sound familiar?) and the other

party 7/5 -- "fractionalization". But the 2020 Presidential election results

were tending so much in one direction that preprogrammed attempts to put in

"corrections" literally overwhelmed the machines' capabilities for fraud,

and election officials "mysteriously" and synchronously stopped the counting

the votes across six states so that "corrections" could be made manually.

Additionally, the same batch of mail-in ballots could be fed into a machine

multiple times. But at least there was a paper trail to go back too, wasn't

there? Well, maybe not.

One of the features of some of these machines is to record an image of each

ballot, in theory making the storing of bulky paper ballots redundant. So

perhaps the actual paper could be discarded since we now have its electronic

image, right? Well, no. Watch this

six-minute video

as a Georgia election supervisor explains how Dominion software allows

changing and adding votes via an "adjudication" process, altering the image.

And the problem is amplified exponentially with no-excuse mail-in voting.

So how do we restore election integrity and loss of faith in the election

process? Obviously, this year's drawn-out voting period and the inherent

weakness of mail-in ballot authentication needs to be addressed. Back to

voting only on Election Day with at least the same identification level as

required to buy a pack of cigarettes, and requiring that absentee ballots

have a witness's signature. But more importantly, fixing the current OCR

machines (not just Dominion's) to produce "one man one vote" as prescribed

by law, with a recount capability, using the original paper ballots, to be

at least as reliable as those mechanical voting machines of old -- with

or without the hanging chads!

Fairfax County Taxpayers Alliance is fighting for you! -- by Jim Ruland, 11/14/2020

Call to Action "We have put together I think the most extensive and inclusive voter

fraud organization in the history of American politics." -- Joe Biden,

11/05/2020

On November 3, I was watching the returns around 12:00am. Trump was up in

Florida and Ohio, as well as up by about 104,000 votes in Wisconsin, 300,000

votes in Michigan, and 700,000 votes in Pennsylvania. The yuan was crashing

and stock futures were up.

Then a series of unfortunate events occurred. Fox News called Arizona

for Biden. It was announced that counting was ceased in key swing states

Wisconsin, Michigan, Pennsylvania, North Carolina, and Georgia. The latter

was due to an alleged water main burst, where no subsequent work order can

be found.

When I woke up November 4, votes had been updated at about 4am in Wisconsin

and about 6am in Michigan to give Biden the lead in Wisconsin and close the

gap to within a few thousand in Michigan. Over the next several days,

rules regarding counting votes, such as having observers, were ignored in

Pennsylvania and Michigan. Courts issued rulings in Pennsylvania to allow

observers that were ignored by election officers. Miraculously, after

several days, the media reported Joe had pulled ahead and was now

"President-Elect." We heard about statistical anomalies in the key swing

states of vote surges for Biden and potential problems with voting machines,

even that the voting machines may have switched votes from Trump to Biden.

Dr. Shiva Ayyadurai produced a video with over 800,000 views -- of voting

patterns in four Michigan counties indicating a pattern of fraud by

switching votes from Trump voters to Biden voters in Republican precincts.

There were other anomalies in this election. President Obama set a record

low for counties won by a winning campaign in 2012 and got 65,915,795 votes,

and Joe Biden won only 477 counties in 2020, but got 78,523,590 votes, or

13,000,000 more votes than President Obama in 2012 and about 9,000,00 more

votes than President Obama in 2008. Republicans didn't lose a House seat

this year and picked up 12 and about 100 state legislative seats despite

predictions of a blue wave. Joe Biden in 2020 underperformed Hillary

Clinton in 2016 except for four cities: Milwaukee, Detroit, Atlanta, and

Philadelphia. Moreover, in 19 bellweather counties historically indicative

of the Presidential winner, all but one went for President Trump, not Joe

Biden.

Absent an investigation, it appears to me that software was used to shift

votes in some counties that were substantially GOP leaning, and when that

steal wasn't sufficient, the counting was stopped so ballots could be dumped

in several states, including Wisconsin, Michigan, Pennsylvania, and Georgia.

Am I right? I do not know, but that is why every American should demand a

canvas of the votes in disputed states to insure every legal vote is counted

and every illegitimate vote is not.

But what do we hear from the media and IT companies? Shut-up, accept the

election, and do not question the election results for the good of the

country. On the above-referenced video, YouTube includes the tag, "The AP

has called the Presidential race for Joe Biden." Trumps tweets, "He won

because the Election was Rigged. NO VOTE WATCHERS OR OBSERVERS allowed,

vote tabulated by a Radical Left privately owned company, Dominion, with a

bad reputation & bum equipment that couldn't even qualify for Texas (which

I won by a lot!), the Fake & Silent Media, & more!" Media immediately

pounces that Trump has issued a concession. Trump doubles down, "He only

won in the eyes of the FAKE NEWS MEDIA. I concede NOTHING! We have a long

way to go. This was a RIGGED ELECTION!"

So apparently the fix is in. My position is simple. I am in this fight as

long as Trump is in this fight. The media doesn't make the official call

on this or any other election. The Constitution lays out the process in

Article 1, Section 1, and the state legislatures make the rules, and the

state legislatures have the power to elect a slate of electors to the House

of Representatives, which then elects the President by a majority of state

delegations.

The GOP, if it acts, actually controls this process. They have control of

the state legislatures in Wisconsin, Michigan, Pennsylvania, North Carolina,

Georgia, and Arizona. Currently, the state delegations in the House favor

Republicans 26-24, and the current election should not reduce that total.

Leaders in the state legislatures have indicated an unwillingness to act.

But the question is, if the GOP won't force an investigation into an

allegedly fraudulent election, or act to reverse such fraud, why would

anyone support the GOP again? Why put yourself forward supporting the GOP,

when the Democrats, allegedly, can create whatever the required votes are

needed to win elections and enact policies, no matter their unpopularity?

So, what to do as individuals? Again, I'm in this fight as long as Trump is

in this fight. For us plebes, the next action is at the state legislatures.

We can organize rallies, just like the Yuuugge rally held in

Washington DC November 14, especially in the state capitols of Wisconsin,

Michigan, Pennsylvania, North Carolina, Georgia, and Arizona. Afterwards,

we will need to rally at Washington, DC, again. Other action items include:

An ancient Chinese curse translates, "May you live in interesting times."

We certainly do, with the fate of our republic at stake.

Fairfax County Taxpayers Alliance is fighting for you! -- by David Swink, 10/11/2020

What the 2020 Election is REALLY About An Oct 6 article in

ZeroHedge was titled "There Are Trillions At Stake... How Washington

Really Works, & Why Its Denizens Despise Trump". The article was rather

long, but it posited that the 2016 and upcoming 2020 elections are more

than about Democrat versus Republican. Both parties are complicit in a

dysfunctional Congress that is now run by K-Street, and that Trump is the

first person to point this out and to throw a wrench in the decades-old

"good-old-boys" network that is lucrative to congressmen and lobbyists

(The Swamp), but devastating to the constituents back home.

Most people think that when they vote for their U.S. House or Senate

representative, it's "Mr. Smith goes to Washington" to enact legislation.

But not a single person in congress has written legislation since around the

mid-1990s. Instead, special interest groups write those 1000- or 2000-page

tomes that -- as Nancy Pelosi would say -- "we have to pass the bill to

find out what's in it". The job of your representative is merely to

sign off on laws that almost certainly do not benefit the American public.

When these bills get passed, the special interest groups reward those

compliant representatives mightily -- even more so if said representative

is a committee chair. The process resembles insider trading on Wall Street,

except the trading is based on who benefits from passage of the law in

question.

Now, legislation is based on ideology. If Hillary had won in 2016, a whole

litany of feeder bills were already poised for eventual passage, and Swamp

creatures would have been happy. But instead, Trump won, and his "America

First" policies were antithetical to all of those DC legislative briefs and

constructs -- representing tens of millions of dollars worth of time and

influence -- which became worthless when Donald Trump won the election.

And there was no special interest or lobbying group, currently occupying DC

office space with any interest in synergy with Trump policy. And this is

why many politicians from both political parties, suddenly without the

ability to acquire personal wealth from this corrupt system, chose to

retire in 2018.

Most of the legislation that was passed by congress and signed by President

Trump in his first term is older legislative proposals, with little indulgent

value, that were shelved in years past. The "First Step act", "Right to

Try", etc. were all shelved by Boehner, Pelosi, Ryan, McConnell, Reid and

others before them. Any new legislation has very little chance of getting

passed under the current system.

Before the 17th Amendment was passed, U.S. Senators were appointed by their

state legislature and were thus immune to such corruption. But with direct

election by the people after 17A was passed, Senators could become just as

tainted by K-Street as their House brethren, though it took many decades for

this temptation to come to pass. Since it takes both houses of Congress to

pass legislation, is stands to reason that if the 17th Amendment is ever

repealed, Congress might have to write its own legislation once again

just to clear the Senate.

In 2016, the people voiced their frustration with both parties to this

system and elected Donald Trump as President. The Left and their media

allies thereafter acquired "Trump Derangement Syndrome" (for which there is

no cure). They have failed with ObamaGate and assorted other allegations

to dislodge Trump from office. Desperate now to prevent his reelection,

they have pulled out all the stops. Blue state politicians are willing to

continue ruining their economies with Covid fear-mongering lockdowns, and

are willing to overlook the well-funded and well-organized rioting by Marxist

organizations like Antifa and BLM -- all in hopes of preventing Trump from

being reelected. (The extended lockdowns are used as an excuse for mail-in

voting, an easy means for facilitating voter fraud -- a specialty of the

Left.)

But perhaps the Left has overplayed its hand in 2020. People are coming to

realize the nefarious machinations of the Left, despite its media and Big

Tech cheerleaders, and will likely counter with revenge across the ballot

on Nov 3.

Fairfax County Taxpayers Alliance is fighting for you! -- by David Swink, 09/10/2020

Vote In Person, and NO to Fairfax Co Bond Issues The "Wuhan Red Death" pandemic has degenerated into a "scamdemic" -- pushed

long beyond its "sell-by" date by the Left and its media allies, including

Big Tech with fully-activated "cancel culture" to filter out any ideas that

this is merely another Asian flu with a

very low mortality rate.

The main purpose appears to be to create such fear in the voting public that

they submit to the call for mail-in ballots with their potential for

rejection and voter fraud. State and local government leaders, especially

in "blue" jurisdictions, seem willing to

follow the narrative, and destroy their economies (and their tax base)

in order to discourage voters from reelecting President Trump.

Which brings us to the main point of this article: If you can get out to

shop at Walmart, you can certainly ensure that your vote is counted by

VOTING IN PERSON. By voting in person at your local precinct, you insure

that your vote is tabulated on election night. You may choose to vote in

person early at local government centers, and your vote will be counted by

the day after the election. In Virginia, you can request a absentee ballot,

fill it out and sign it in front of a witness (made not mandatory just this

year by the General Assembly). Still, you should drop it off at a local

government drop box rather than risk having it lost or stolen from the mail.

Absentee ballots will be verified and tabulated within several days after

the election.

Five U.S. western states automatically mail ballots to all registered voters

on their voter roles. Even so, most of their citizens choose to

vote in person

to ensure safe and prompt vote tabulation. So our advice is to vote in

person -- on election day if possible (Nov 3).

Early voting

is available at the Fairfax Government Center starting Sept 18,

and 14 satellite government centers and libraries starting Oct 14

-- hence the reason for writing this Message a month early.

As of this writing, there is no official ballot yet available from Fairfax

County, but we have the gist of it:

Items 1-3 are not at issue here. On item 4, some of our board members

question the "independent" part of the proposed redistricting commission.

On item 5, FCTA encourages voters to vote NO on all four bond issues:

Regarding transportation, over 80% of Fairfax County demand is for highways,

NOT transit. Yet for over a decade, our Supervisors and the General Assembly

have voted an ever increasing proportion of transportation funds to transit

-- 87% in FY2020. The proposed $160M transportation bond does not specify

for what projects and where funds will be used. Given major post-COVID

declines in Metro ridership so far in 2020, the Metro board's refusal to

increase peak period Metrorail fares, and uncertain future revenues,

the transportation bond issue must certainly be opposed.

As FCTA president

Arthur Purves explains:

current bond debt service is crushing; the County has reached its AAA bond

rating limit; the County is not transparent about any of this; and Metro

is increasingly an unaccountable funding Black Hole. Taxpayers simply can't

afford to continue. (Historically, tax referenda fail, while bond issues

-- which are taxes plus interest -- pass easily. For some reason, voters

seem to view bonds as no-cost items.)

With the County having kept the schools closed to in-person learning, some

of the County's massive school system budget could perhaps be repurposed

for some of the dollar amount of the bond requests. Considering the

disappointing closure of schools against parents' wishes, voters should

express their displeasure by voting NO on all of the aforementioned bond

issues.

Fairfax County Taxpayers Alliance is fighting for you! -- by Max Ehrmann, 1927

"Desiderata" (on Life during Chaos) GO PLACIDLY amid the noise and haste,

and remember what peace there may be in silence.

As far as possible without surrender

be on good terms with all persons.

Speak your truth quietly and clearly;

and listen to others,

even the dull and the ignorant;

they too have their story.

Avoid loud and aggressive persons,

they are vexations to the spirit.

If you compare yourself with others,

you may become vain and bitter;

for always there will be greater and lesser persons than yourself.

Enjoy your achievements as well as your plans.

Keep interested in your own career, however humble;

it is a real possession in the changing fortunes of time.

Exercise caution in your business affairs;

for the world is full of trickery.

But let this not blind you to what virtue there is;

many persons strive for high ideals;

and everywhere life is full of heroism.

Be yourself.

Especially, do not feign affection.

Neither be cynical about love;

for in the face of all aridity and disenchantment

it is as perennial as the grass.

Take kindly the counsel of the years,

gracefully surrendering the things of youth.

Nurture strength of spirit to shield you in sudden misfortune.

But do not distress yourself with dark imaginings.

Many fears are born of fatigue and loneliness.

Beyond a wholesome discipline,

be gentle with yourself.

You are a child of the universe,

no less than the trees and the stars;

you have a right to be here.

And whether or not it is clear to you,

no doubt the universe is unfolding as it should.

Therefore be at peace with God,

whatever you conceive Him to be,

and whatever your labors and aspirations,

in the noisy confusion of life keep peace with your soul.

With all its sham, drudgery, and broken dreams,

it is still a beautiful world.

Be cheerful.

Strive to be happy.

Fairfax County Taxpayers Alliance is fighting for you! -- by David Swink, 07/15/2020

Public Unions Sanction Police and Teacher Misconduct When George Floyd was killed, the Minneapolis offending police officer had

already been cited for

18 prior

complaints in 19 years. He was still on the force because the police

union would not allow him to be fired. This is not an aberration. Bad cops

are protected by their unions across the country. If the infraction is

serious enough, the union will convince the offending officer to leave the

department for another secured assignment in such garden spots as

Baltimore or Detroit.

There is a similar problem in our public schools. It is nearly impossible

to fire bad teachers, due to the job protection enforced by their unions.

In New York City, bad teachers can be assigned to "rubber rooms", where they

can continue to draw full salary while at least "doing no harm" to students.

Most other jurisdictions cannot afford this pay-to-do-nothing luxury, and so

bad or incompetent teachers are simply reassigned, from a higher-performing

school in a prosperous neighborhood, to a lower-performing school in a poor

neighborhood.

In Fairfax County, bad teachers are typically processed out of prosperous

areas like McLean or Great Falls, to schools elsewhere in the county. But

rather than address this bad-teacher problem directly, the School Board

advocates "busing" -- a "social justice" concept that is part of the George

Soros-funded 'One Fairfax' model. So the Board would propose

reversing the situation, by sending the lower-performing students afflicted

by those bad teachers imposed on them to the County's higher-performing

schools from which those same bad teachers were ejected.

And it is the teachers' unions that are promoting the irrational

schools-half-opened policy that Fairfax County has thus far promoted for

this fall. Plus perhaps even "hazardous-duty" pay for teaching only half

the student coursework. Meanwhile, the coronovirus death rate in the County

stands at 0.044% (in Va, 0.023%) -- less than for the seasonal flu -- while

school-age children are virtually immune from serious effects and are not

vectors for the spread of this virus.

Even FDR agreed that there is no place for unions in the public service

realm, as government workers are inherently secure in their positions --

it's the taxpayers which have no such protection. JFK later changed the

rules, allowing government workers to unionize. And in Virginia, Gov.

Northam & Co. now allow government workers to unionize, and Fx Co School

Board has vowed to recognize the unions, possibly overcoming Virginia's

Right to Work laws. (Of course, our School Board bargains with the union

even now, as if the teachers belonged to the union.)

So public unions are now a fact, but their power over hiring/firing decisions

should be recognized as not serving the public interest, and throttled

accordingly.

Fairfax County Taxpayers Alliance is fighting for you! -- by David Swink, 05/28/2020