|

Fairfax County

Taxpayer's Alliance

A

A

A

A

|

|

Fairfax County Tax and Budget Issues

Fairfax Co Tax and Budget Issues...

(Here's the Fairfax Co Budget Calendar)

-

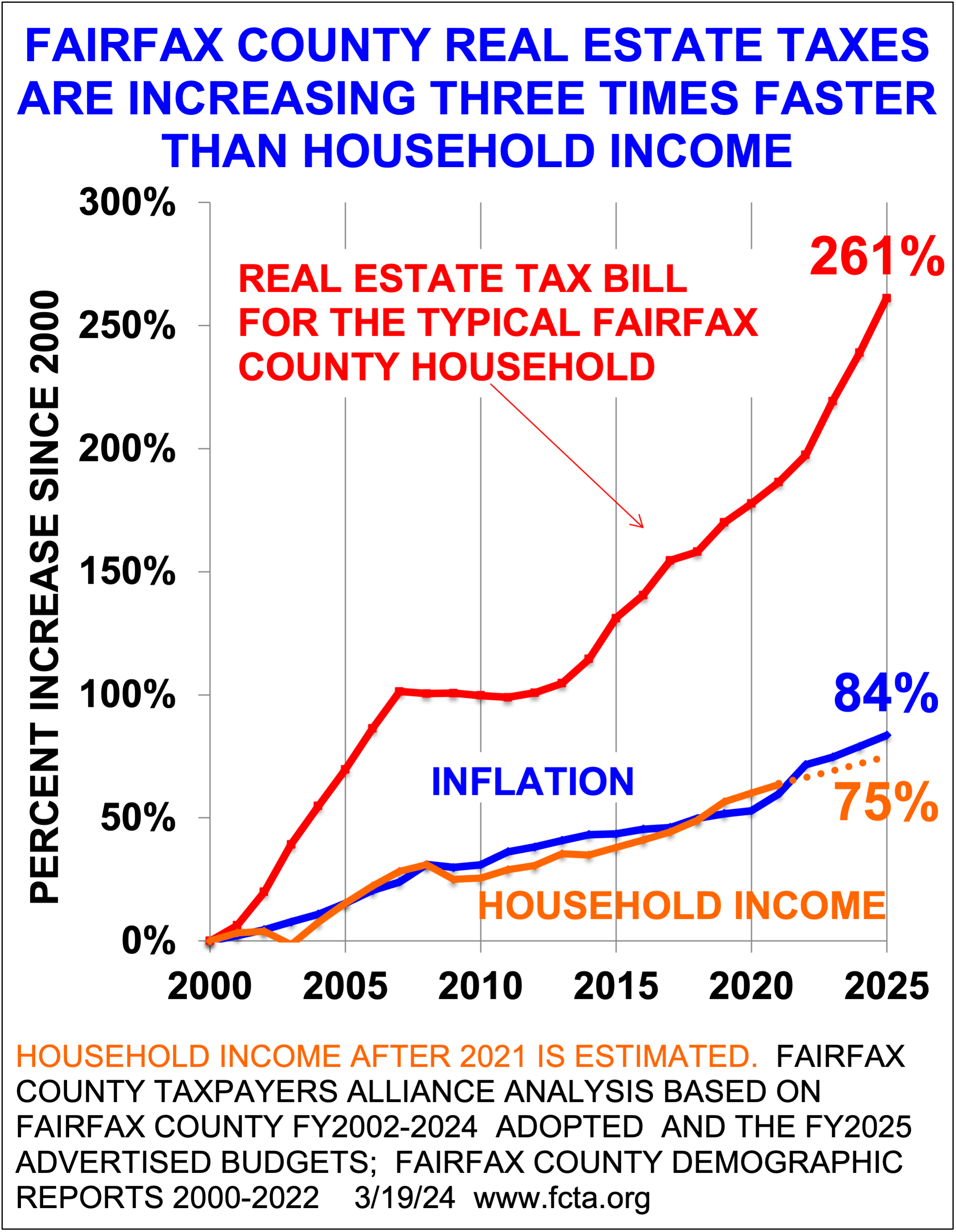

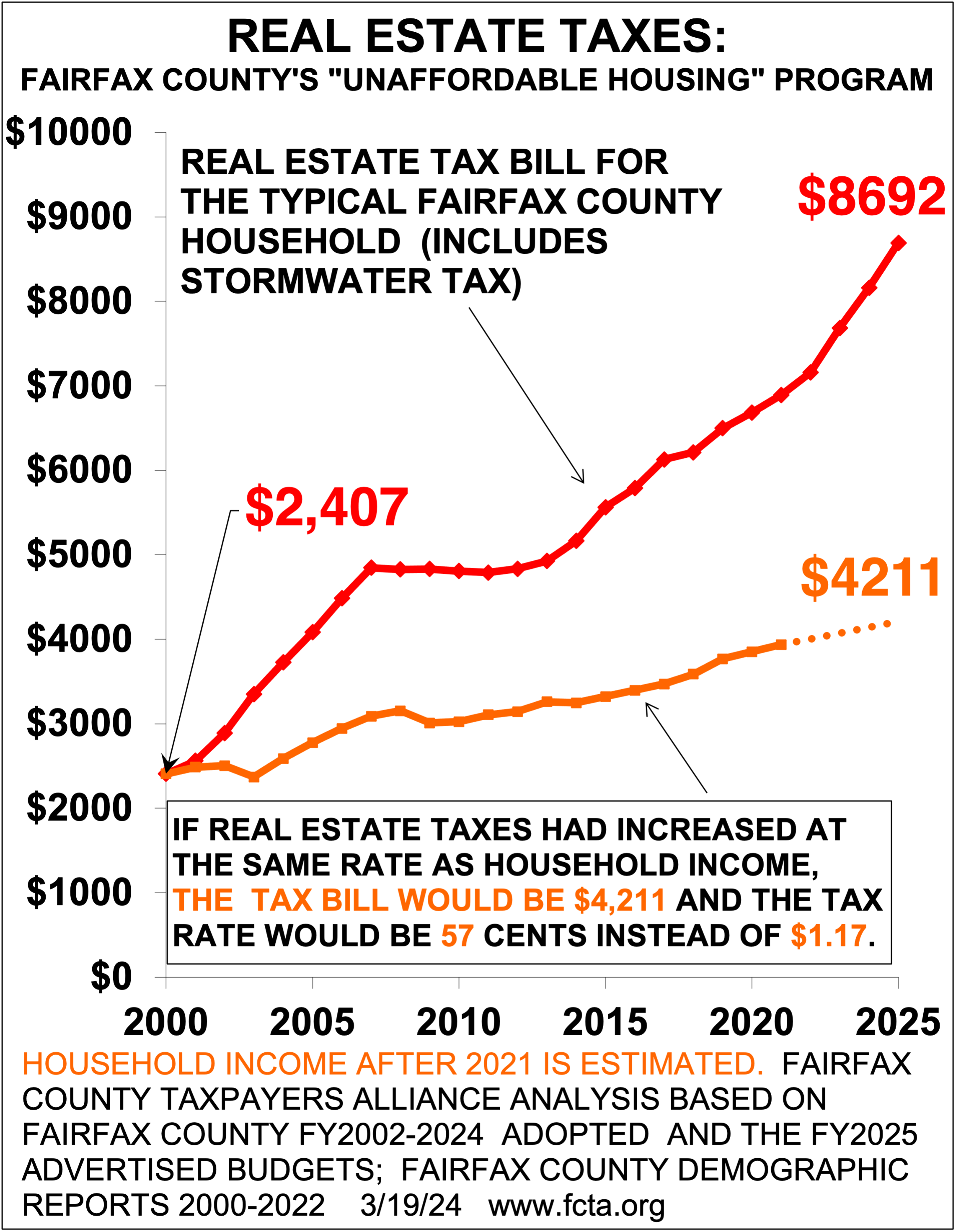

Here's how your real estate taxes have risen over the years...Most of these tax increases are not spent to improve county services but to subsidize the soaring cost of school and county pensions, zero-deductible medical insurance, and raises. Here are the published Fairfax Co Real Estate Tax Rates.

|

|

2024-04-16: FCTA: Testimonies to BOS on the County Budget, by FCTA board members

2024-03-22: FCTA: Fairfax County Advertised Budget for FY2025 -- from Washington Times B5

2024-03-14: FCTA: Fairfax County Notice of Proposed Real Property Tax Increase

Public posting, one half of page A5 in the Washington Times. Includes an average increase of 2.86 percent for residential and a decrease of 1.24 percent for non-residential real estate. Public hearing April 16, 2024 at the Gov't Center.

2024-02-26: Fx GOP: Real Estate Tax Rate Poised To Go Up. Is The Sales Tax Next?

Fairfax County residents are bracing for a double-whammy to their property tax bills with a proposed 4-cent increase to the real estate property tax rate (to $1.135 per $100 assessed value) along with rising home valuations. (Compared to: Arlington $1.038; Prince William $0.966; Loudoun $0.875; Stafford $0.9175).

2024-02-13: FXX Now: FCPS seeks 10.5% budget increase from taxpayers, by Angela Woolsey

With the FCPS already gobbling 53% of the budget, I guess [FCPS Superintendent Dr. Michelle Reid] must think that taxpayers will be held hostage to the mantra our "world class schools" require more and more support staff and "innovation" as in electric buses. -- Comment from reader.

2023-12-14: Gazette Leader: Does Fairfax BOS really care about homeowners? -- Editorial

Gov't officials have outlined plans for a third consecutive year of big staff pay raises. When you couple that with an ever-more fiscally ravenous school system (without corresponding results) and the cratering valuations of commercial office buildings and some retail venues, the cost of government is going to be shifted to the residential side of the ledger. So get ready: Fairfax gov't thinks it deserves your money more than you do.

2023-09-26: FCTA: Testimony at BOS FY2023 Carryover Budget Hearing, by Arthur Purves

At issue is $652 million, the amount left over from FY2023 -- $321 million in the General Fund and $331 million from the Schools. Your choice should be simple: Return leftover tax revenues to the taxpayers! via reduction in future tax rates.

2023-08-15: FCTA: Reasons to Oppose 2023 $435M School Bond Referendum, by Arthur Purves

Since 1994 Fairfax County and Schools have spent $360M (plus interest) on four projects that were so controversial that the supervisors were afraid to put them up to referenda. The latest massive $435M proposal is even less justified, as schools have an excess $190M, and interest on bonds adds over $200 to the average real estate tax bill.

2023-07-10: FCTA: Fairfax Co, Vienna Real Estate Taxes Over Last 40 Years, by David Swink

A FCTA board member, and Vienna resident since 1975, provides raw real estate tax data for nearly forty years, from 1976 onward, for both Fairfax County and the Town of Vienna.

2023-05-30: Gazette Leader: FCPS asking for $435M bond referendum in Nov, by Brian Trompeter

Fairfax Co Voters will be asked in November to pass yet another School bond issue -- now a biannual ritual: $435M this year; $360M in 2021; $360M in 2019; $317M in 2017; and $250M 2013. [If this were called a 'tax', voters would reject it; but call it a 'bond' (tax + interest), and the voters will eagerly pass it.]

2023-05-09: WUSA: Fairfax Co 2023 real estate taxes rise 5.5% on average, by Bruce Leshan

Fairfax County supervisors lowered last year's high $1.11/$100 residential real estate tax rate to a still-high $1.095/$100. Considering assessment increases, average actual taxes will increase by about 5.5%, vs 7% using the former rate.

2023-05-04: FCTA: Vienna posts final notice for budget and real estate tax increase

(Final adoption May 15.)

2023-04-11: FCTA: Testimonies to BOS on the County Budget, by FCTA board members

Fx Co real estate assessments were up nearly 7% this tear, so Virginia Code automatically reduced last year's tax rate $1.11 down to $1.05 per $100 valuation for this year. The County supervisors want to raise this back up to $1.11 and force taxpayers to pay an additional 7% over what Virginia recommends. Are they going to get away with it?

2023-03-29: FCTA: Vienna posts notice for proposed FY2024 budget -- from Washington Times B6

The Town of Vienna tweaked the proposed real estate tax rate down only slightly, so your recent assessment increase will translate into a roughly 6.9% increase on your next tax bill. (Public hearing on April 10, 2023.)

2023-03-24: FCTA: Fairfax County Advertised Budget for FY2024 -- from Washington Times B5

2023-03-22: Patch: 30% BOS Pay Raise Approved, in 8-2 Vote, by Michael O'Connell

"But the supervisors haven't earned it: ... recklessly raising real estate taxes ... losing police officers ... spending millions on non-existent climate crisis ... creating havoc with unconstitutional lockdowns and vaccine mandates." -- Arthur Purves, president of the Fairfax County Taxpayers Alliance

2023-03-17: FxCo: FY2024 Budget Q&A for Supervisors and School Board Members

2023-03-09: FCTA: Fairfax County Notice of Proposed Real Property Tax Increase

Public posting, one half of page A7 in the Washington Times. Includes an average increase of 6.97 percent for residential and an increase of 1.65 percent for non-residential real estate. Public hearing April 11, 2023 at the Gov't Center.

2023-02-28: Gazette Leader: Proposed Fx Co budget goes big on pay boosts, by Brian Trompeter

Fairfax County employees, as well as ones working for the school system, would receive healthy pay raises under County Executive Bryan Hill's proposed fiscal 2024 budget -- but this would come largely at the expense of homeowners.

2023-01-25: Fx Times: Fx libraries funding Hannah-Hyphenated-History author, by Asra Nomani

Fairfax County Public Library officials are paying controversial writer Nikole Hannah-Jones, author of the "1619 Project" $35,350 for a one-hour lecture on Feb. 19 at the McLean Community Center, with a price tag that amounts to $589 per minute, according to a copy of the contract obtained by the Fairfax County Times.

2022-11-16: FCTA: How FCPS Got Extra $100M to Teach 10,000 Fewer Students, by Arthur Purves

Presentation to FCRC: School board replaced one-time Elementary and Secondary School Emergency Relief(ESSER) COVID relief funding with a $100M real estate tax hike and a $90M increase in state funding.

2022-10-22: FCTA: How to Rein In Fairfax County Real Estate Taxes, by Arthur Purves

Presentation and speech made at FCTA's annual luncheon.

2022-10-05: FCTA: Fairfax County's Unaffordable Housing Program, by Arthur Purves

Presentation to the Greenspring Republican Club: RE tax up 7%, Car tax up 32%, ...

2022-08-12: Bacon's Rebellion: Turbocharged Fairfax Car Tax Burden, by Bill Tracy

Fairfax County just mailed out its 2022 Car Tax bills, and the tax increase is substantial. My 2020 Toyota RAV4 tax was $558 in 2021, and would normally have been reduced by $133 in 2022. Instead, the tax increased by $227 to $785. (Guess I'll keep my ~$27K car rather than pay the property tax on today's average $47K vehicle!)

2022-05-05: FCTA: Vienna posts final notice for budget and real estate tax increase

The Town of Vienna tweaked the real estate tax rate down only slightly, so your (10%+) assessment increase will translate into a 7 to 9% increase on your next tax bill. (Final adoption May 16.)

2022-04-12: FXX Now: What should Fairfax County prioritize in its budget?, by David Taube

Take the poll: Preventing tax increases, Transportation, Public safety and recruitment, More affordable housing, Money for libraries and parks, Schools, County health funding?

2022-04-12: FCTA: Testimonies to BOS on the County Budget, by FCTA board members

Fx Co real estate assessments were up nearly 10% this tear, so Virginia Code automatically reduced last year's tax rate $1.14 down to $1.06 per $100 valuation for this year. The County supervisors want to raise this back up to $1.14 and force taxpayers to pay an additional 8% over what Virginia recommends. Are they going to get away with it?

2022-03-25: FCTA: Fairfax County Advertised Budget for FY2023 -- from Washington Times B5

2022-03-24: Bacon's Rebellion: Fairfax's Un-Affordable Housing Program, by Arthur Purves

If you live in Fairfax County and are over 50, you may have received from the county a five-page 120-question survey to "... inform the county's ... Future Aging Plan". Here's the Fairfax County Taxpayers Alliance Future Aging Plan: Stop taxing us out of our homes!

2022-03-10: FCTA: Fairfax County Notice of Proposed Real Property Tax Increase

Public posting, one half of page A7 in the Washington Times. Includes an average increase of 9.57 percent for residential and an increase of 2.27 percent for non-residential real estate. Public hearing April 12, 2022 at the Gov't Center.

2022-02-26: NextDoor: Taxpayer Comments on Fairfax Co 2022 Real Estate Assessments

A compilation of NextDoor postings just after the proposed Fairfax County FY2023 budget increases were announced, with average assessments slated to increase by 9.75%. Provides the gist of taxpayer feeling.

2022-02-25: Fx Times: Proposed FY2023 Fx Co budget increases real estate taxes by 9.57%

"Homeowners are facing a 10% increase in real estate taxes so county and school employees can get 6% raises. The supervisors can cut the real estate tax by 10 cents to offset the increase in assessments. Any rate cut less than 10 cents is a tax hike." -- FCTA president Arthur Purves

2021-10-16: FCTA: Policies Needed for Cutting Taxes, by Arthur Purves

Presentation and speech made at FCTA's annual luncheon.

2021-09-15: Sun Gazette: Fairfax County board passes 5-cent tax on plastic shopping bags

The Fairfax County Board of Supervisors this week voted 9-1 to approve a 5-cent tax on plastic bags at grocery stores, convenience stores and drugstores. The tax will go into effect Jan. 1, 2022. Supervisor Pat Herrity of the Springfield district cast the only dissenting vote.

2021-04-13: FCTA: Testimonies to BOS on the County Budget, by 5 FCTA board members

Reduce the real estate tax rate from the currently-proposed $1.15 rate to perhaps $1.08, so that there will be no impact on the taxpayer -- especially after losing some 9,000 students due to closure of the public school system. Raise the retirement age of newly hired employees to age 62. Set up an Office of Inspector General (OIG).

2021-03-11: FCTA: Fairfax Co Real Estate Tax Increase -- +4.45% residential (-4.05% comm)

Public posting, page A9 in the Washington Times. Proposed rate of $1.15 unchanged from previous year. But average assessments increased 4.45% for residential, and decreased 4.05% for commercial. So an effective tax increase of 2.01%.

2020-11-24: FxCo: FY2022 Budget Forecast - Pandemic Impacts Projected Revenue, Priorities

FY2022 revenue is projected to remain flat, with no growth anticipated in Real Estate or Personal Property taxes. As a result, the budgetary shortfall forecast for FY2022 is $40.6 million for the county and $32.5 million for FCPS, which must be addressed before the budget is adopted in May 2021. (Real estate values expected to rise +3%, so your taxes will go up again without a proportional decrease in the tax rate.)

2020-10-10: Bacon's Rebellion: Fairfax Tax Rate the Same, but Tax Burden Up, by E. Jaksetic

If board members had wanted to provide meaningful tax relief during the COVID-19 pandemic, they could have "frozen" everyone's real estate tax bills for 2020 at the same level as their real estate tax bills for 2019. Instead, increased property assessments were allowed to effect a tax increase.

2020-09-11: FxCo: Notice Appropriating Supplemental Funds -- Add'l $2,647,337,562 for FY2021

2020-09-11: NR: Fairfax County Is Running Empty School Buses, by Kyle Smith

This is like something out of some kind of Soviet central-planning misadventure: Fairfax County, Va., wants to keep paying its school-bus drivers even though its schools are operating online. The solution? Send the drivers out to drive anyway. Likewise with food service workers in the empty schools: Zero layoffs.

2020-09-07: FCTA: Vote NO on the Fairfax County FY2020 Bond Referenda, by Arthur Purves

Four bond issues to be voted on Nov 3: 1) Community and Health and Human Services ($79 million); 2) Libraries ($90 million); 3) Parks ($112 million); 4) Transportation ($160 million). But current bond debt service is crushing; the County has reached its AAA bond rating limit; the County is not transparent about any of this; and Metro is an unaccountable funding Black Hole. Taxpayers simply can't afford to continue.

2020-05-05: Sun Gazette: Fairfax budget hearing brings out annual fiscal tug-of-war

Fairfax County residents who testified last week about County Executive Bryan Hill's proposed FY 2021 budget as usual pressed for schools and social-services spending, but many also were intent on curbing extraneous spending -- including Charles McAndrew, Arthur Purves, and Tom Cranmer of the Fairfax County Taxpayers Alliance.

2020-05-05: FxCo: No Changes to Trimmed Down FY 2021 Budget Proposal; RE tax rate at $1.15

The Fairfax County Board of Supervisors approved the FY 2021 Budget Markup today, Tuesday, May 5. The board made no changes to the revised FY 2021 Budget County Executive Bryan Hill proposed in early April. The budget maintains the current Real Estate Tax rate of $1.15 per $100 of assessed value. Budget adoption is scheduled for Tuesday, May 12.

2020-04-28: FCTA: Presentation to BOS on the County Budget, by Bill Peabody

Over $11 billion has been lost since 2003, as people walked away from high taxes. Fix the budget in the long term by: 1) Keeping raises in line with the private sector; 2) Raising the retirement age to 62 from 55. County pensions are way better than private companies can afford -- convert to 401k's like they do. Taxpayers should not be liable for your pension when their own is at risk.

2020-04-28: FCTA: Presentation to BOS on the County Budget, by Tom Cranmer

1) Covid-19 scare is overblown; 2) BOS should encourage more healthy living; 3) open Fairfax for business with social distancing; 4) reduce budget by $241M to match decline in RE values; 5) reduce FCPS budget; 6) promote home schooling to reduce FCPS costs; 7) reduce Fairfax's Metro subsidy by $412M.

2020-04-28: FCTA: Presentation to BOS on the County Budget, by Chuck McAndrew

Reduce the real estate tax rate to below the $1.15 current proposed rate to perhaps $1.12 so that there will be no impact on the taxpayer. Raise the age of newly hired employees and for those employees under 40 years of age to age 62, the same as the earliest age to obtain Social Security benefits.

2020-04-28: FCTA: Testimony at BOS FY2021 Budget Hearing, by Arthur Purves

In summary, we have soaring real estate taxes for raises that may be the result of a conflict of interest; schools that discriminate against Hispanics and African-Americans, with generous funding from a predominately white board of supervisors; and a devastating government economic lockdown that has not been supported by evidence and is unconstitutional.

2020-04-14: Sun Gazette: Fairfax budget plan downscaled in wake of virus, economic concerns

In response to adverse economic impacts from the COVID-19 lockdown, Fairfax County government officials have removed major planks from the county's proposed fiscal year 2021 budget -- including wage increases for employees and a 3-cent hike in the real-estate-tax rate -- and will hold required public hearings on the budget two weeks later than previously scheduled.

2020-04-14: FCTA: Testimony at BOS FY2021 Effective Tax Rate Hearing, by Arthur Purves

After the COVID-19 lockdown, the County Executive no longer recommends an increase in the Real Estate Tax Rate, keeping it at $1.15 per $100 of assessed value. But to negate tax increases due to increased assessments, the tax rate should actually be lowered to $1.12! After all, county employees at least still have their jobs, while many privately-employed taxpayers do not.

2020-04-07: FxCo: County Exec Proposes Revised Post-Lockdown FY 2021 Budget

County Executive Bryan Hill has proposed a new Fairfax County FY 2021 Budget drastically different from that which he presented in February, prior to the COVID-19 global pandemic and its massive impact on the economy and county residents. The new plan eliminates the proposed three-cent real estate tax rate increase and compensation increases for county employees.

2020-04-07: Patch: New Fx Co Budget Proposal Reflects Coronavirus Impact, by M. O'Connell

1) Maintains the current Real Estate Tax rate of $1.15 per $100 of assessed value; 2) Scraps the 4% Admissions Tax on movie tickets; 3) Slashes the number of new positions from 177 to 20; 4) Eliminates all pay adjustments for county employees; 5) Decreases employee benefits by $5.63M; 6) Reduces increase in Schools Operating Fund from $85.52M to $7.31M.

2020-03-27: FCTA: Fairfax County Advertised Budget for FY2021 -- plus Coronovirus Update

2020-03-12: FCTA: Fairfax County Notice of Proposed Real Property Tax Increase

Public posting, one half of page A7 in the Washington Times. Includes an average increase of 2.65 percent for residential and an increase of 2.87 percent for non-residential real estate. Public hearing April 14, 2020 at the Gov't Center.

2020-03-10: FCTA: Fairfax County Town Hall Budget Meeting (Sully), by Charles McAndrew

Joe Mondoro, Chief Financial Officer of the Fairfax County Government gave the bulk of the presentation.

2020-03-02: FCTA: Should you appeal your real estate tax assessment?, by Anon Fx Co resident

Real estate tax assessments have been mailed. These are required by state law to be uniform and at fair market value (FMV). Whether your assessment increased or decreased does not tell you whether your home's new assessment is accurate. Before you appeal your real estate assessment, do your homework.

2020-02-25: Patch: Real Estate Tax Hike In Fairfax's Proposed Budget, by Michael O'Connell

Fairfax County residents could see the average real estate tax bill increase by $346 next year. The FY 2021 Budget Proposal County Executive Bryan Hill presented Tuesday, Feb. 25, includes an increase of the real estate tax rate by 3 cents per $1.18 per $100 of assessed value (which also increased considerably this year).

2020-01-17: Sun Gazette: Democrat Fairfax supervisors press for local taxing authority

Fairfax County supervisors in a 9-1 party-line vote Jan. 14 approved a resolution asking the General Assembly to grant the county the same taxation authority as that accorded to Virginia's towns and cities. So a Meals Tax or other such extortion could be implemented without the now-required voter referendum (anathema to big-spending Democrats).

2019-12-13: Fx Times: One-cent RE tax increase for "affordable housing"?, by Angela Woolsey

Fairfax County could potentially dedicate an extra penny to its affordable housing penny fund with the upcoming FY 2021 budget by adding a cent to the real estate tax, Lee District Supervisor Jeff McKay says. (... by making your taxes less affordable?)

2019-09-06: FxCo: Notice Appropriating Supplemental Funds -- Add'l $2,490,354,357 for FY2020

2019-08-15: FCTA: Internal Audit Functions of Prince William Co vs Fairfax Co

PWCo: Brings "a systematic and disciplined approach to evaluating and improving the effectiveness of the organization's risk management, internal control, and governance processes." (ie - efficient use of taxes)

FxCo: To "gain reasonable assurance that management complies with all appropriate statutes, ordinances and directives." (ie - legal use of taxes)

2019-04-17: Connection: Public Weighs in on Fairfax County Budget Priorities, by Andrea Worker

During the April 9-12 Fairfax County Budget Public Hearings, representatives from unions, councils, organizations, civic associations, social services, nonprofits, parks, environmental groups, and private citizens came before the board. Most were there begging for more. The exception was Arthur Purves of the Fairfax County Taxpayers Alliance, arguing against the monies directed toward the FCPS.

2019-04-15: Sun Gazette: At Fairfax budget hearing: "Restrain spending!", by Brian Trompeter

Competing interest groups made their cases and cast a few barbs April 9 at the first of three Fairfax County Board of Supervisors public hearings on the proposed fiscal 2020 budget (including Arthur Purves, president of the Fairfax County Taxpayers Alliance).

2019-04-11: FCTA: Presentation to BOS on the County Budget, by Chuck McAndrew

1) For the past 20 years, real estate taxes for the typical homeowner have increased three times faster than household income. 2) FCPS budget has increased at least two or three times the inflation rate. 3) Taxes moderated this (election) year. 4) The County badly needs an Office of Inspector General (OIG).

2019-04-10: FCTA: Chiding the Fairfax Co BOS on County Spending, by James Hawkins

This FCTA member from Annandale chides the Supervisors for traffic problems, school spending, various forms of welfare such as "Affordable Housing", and failing to address the public pension problem. He hopes candidates in the upcoming BOS elections will realign the County's priorities.

2019-04-09: FCTA: Presentation to BOS on the School Quality and Budget, by Arthur Purves

Arthur Purves, FCTA president, addresses two topics: Excellence and equity in Fairfax County Public Schools (FCPS) and the need for $112M in raises.

2019-03-29: FCTA: Fairfax County Pay Raises vs Inflation -- FY2000-FY2020, by Arthur Purves

2019-03-29: FCTA: Needed: Candidates Who Will Build a Mandate to Cut Taxes, by Arthur Purves

2019-03-22: FCTA: Fairfax County Advertised Budget for FY2020 -- from Washington Times B5

2019-03-13: FCTA: Fairfax County Town Hall Budget Meeting (Sully), by Charles McAndrew

Only SIX people attended this meeting, lead by Supervisor Kathy Smith.

2019-03-07: FCRC: Fairfax County's 2020 Budget: More Reckless Spending, by Arthur Purves

The Fairfax County Fiscal Year 2020 advertised budget continues the Board of Supervisors and school board's decades-long pattern of reckless spending.

2019-03-07: FCTA: Fairfax Co Real Estate Tax Increase, 2.45%, all in assessment increases

Public posting, page A8 in the Washington Times. Proposed rate of $1.15 unchanged from previous year. But average assessments increased 2.45 percent. So an effective tax increase of 2.45 percent.

2019-03-06: ArlNow.com: Arlington's School Budget Unsustainable Long-Term, by Peter Rousselot

Neither Arlington's School Board nor the County Board are publicly acknowledging or explaining the long-term fiscal impact of APS's operating-budget growth, which over the next 10 years will: 1) shift tens of millions of dollars away from other essential county services and 2) require painful, annual tax-rate increases solely to fund school enrollment growth. (et tu Fairfax?)

2019-03-02: FCTA: Fairfax County Town Hall Budget Meeting (Hunter Mill), by Charles McAndrew

Notes on the Fairfax County FY2020 real estate taxes, budget, and employee compensation. Also the FCPS budget and employee compensation.

2019-02-28: FCTA: Arlington Real Estate Tax Increase, 5.4%... compared to Fairfax Co's 2.45%

Public posting, page A13 in the Washington Times. Includes an average increase of 5.4 percent for residential and no increase for non-residential real estate.

2018-12-08: FCTA: Fairfax County Loses Taxpayers to Other Virginia Counties

Taxpayers in Fairfax County, with Average Gross Income (AGI) totaling over $10 billion, have left Fairfax County. Most have moved to neighboring Loudoun and Prince William counties, which have lower tax rates.

2018-12-08: FCTA: Fairfax Co Loses Taxpayers, Virginia Less So

Fairfax County had a net loss of $10.08 billion in annual Adjusted Gross Income (AGI) between 1992 and 2016. The state of Virginia had a net loss of $1.60 billion in annual AGI.

2018-11-05: FCTA: Vote NO on the Fx Co Public Safety Bond Referendum, by Arthur Purves

Fairfax County's 2018 Public Safety Bond Referendum proposes borrowing $182 million for the renovation of facilities built 30 or more years ago. While the purposes of the referendum are reasonable, the county's financial management is not.

2018-10-23: FxCo: Fairfax County Taxes and Fees -- compiled by FCTA

2018-09-07: FxCo: Notice Appropriating Supplemental Funds -- Add'l $2,319,768,586 for FY2019

2018-08-05: Vienna: Infrastructure needs drive water and sewer rate increases

Vienna's 131 miles of water and sewer lines are in critical need of replacement, and the town has outlined a replacement strategy -- increasing water rates by 3.5% and sewer rates by 10% starting July 1. Residential customers will see an average increase of $13 on their quarterly bill, while most commercial customers will see a quarterly increase of $100-$150 in fixed and consumption fees.

2018-06-09: Fairfax Co and Public School budget excesses over the years, by Arthur Purves

Stand up for transparency in government. Support the Fairfax County Taxpayers Alliance.

2018-05-04: FxCo: Another "Unsustainable" Tax Increase, by Fx Co Supervisor Pat Herrity

On May 1, the Fairfax County Board of Supervisors voted 8 to 2 for a 2.25 cent increase in the tax rate on homeowners (2 cent real property and .25 cent increase in storm water tax). Together with the rise in assessments, taxes on the average homeowner will go up over 4.5% this year and 26% over the last five years.

2018-05-01: Connection: Sharon Bulova's Missing Numbers -- letter by FCTA's Arthur Purves

County Chairman Sharon Bulova's April 25 opinion piece, "Budget Hits All the Right Notes", about the proposed FY2019 real estate tax hike, is misleading. Among other things, she omits the stormwater rate, which bumps the $1.15 proposed real estate tax rate to $1.1825.

2018-04-25: FCTA: Response to Fairfax Co FY2019 Budget Markup, by Arthur Purves

In her 4/24/18 Bulova Byline, County Chairman Sharon Bulova's statements on the proposed FY2019 real estate tax increase are misleading. FCTA rejects taxation by misrepresentation.

2018-04-12: FCTA: Presentation to BOS on Budget and Tax Increases, by Chuck & Linda McAndrew

1) Real estate taxes are projected to increase 5% this year, three times the rate of inflation. 2) The County's Supplementary Retirement System (ERFC) is unique to the area and should be phased out. 3) The DROP program sanctions double-dipping, and should be DROPped. 4) And the County's UNFUNDED PENSION LIABILITY of $5.6 BILLION is seemingly ignored by the County Board.

2018-04-11: FCTA: "Fairfax County's War Against the People", by Thomas Cranmer

No political correctness here! At the Fairfax County Board of Supervisors FY2019 Budget Hearing, FCTA's Tom Cranmer lays out what ails Fairfax County in the areas of taxes, crime, school problems, traffic congestion, tolls, Metro, pensions, DROP, and derogatory statements by the new County Executive.

2018-04-11: FCTA: Testimony at BOS FY2019 Budget Hearing, by Arthur Purves

For nearly 20 years this board has been raising real estate taxes two or three times faster than household income. Coincidentally, IRS data indicates Fairfax County has seen a net out-migration of $10 billion in wealth. Professional jobs are still below the 2012 level, while lower-salary jobs are being added are in education, health services, financial activities, and hospitality. ...

2018-04-09: MCA: Resolution on the Fairfax Co and FCPS Advertised FY2019 Budget Plan

Whereas, the FY2019 Advertised Budget of $4.3 billion is 4.7% larger that the FY2018 Adopted Budget, Therefore be it resolved, that the McLean Citizens Association urges the County to implement meaningful cost savings in FY2019 and thereby increase the property tax rate by less than the advertised 2.5 cents per $100 of assessed value.

2018-04-03: Loudoun Now: Loudoun Tax Rate Cut 4 Cents, Schools $14.9M ... vs Fairfax !!!

The Loudoun Board of Supervisors on Tuesday approved a $3.64 billion fiscal year 2019 budget that includes a 4-cent real estate tax rate cut. The county's new real estate tax rate of $1.085 per $100 of assessed real estate value is the lowest since 2008, the last time the tax rate was below a dollar.

2018-03-08: FCTA: Fairfax Co Real Estate Tax Increase, 4.85%... compared to Arlington's 1.3%

Public posting, page A5 in the Washington Times. Proposed rate of $1.155 (currentlyly $1.130) per $100 of assessed value (would need to be $1.1016 per $100 to offset average 2.58% assessment increase). So an effective tax increase of 4.85 percent.

2018-03-07: FCTA: Fairfax County Town Hall Budget Meeting in Chantilly, by Charles McAndrew

1) The proposed budget for ERFC is $94.6 million for FY 2019. (ERFC should be phased out.) 2) The DROP program sanctions double-dipping, and should be DROPped. 3) The county's UNFUNDED PENSION LIABILITY including the FCPS, the ERFC, and VRS is $5.6 BILLION!! (Mortifying!)

2018-03-01: Sun Gazette: Fairfax County budget plan headed in wrong direction -- Editorial

Executive Bryan Hill's budget presentation last week can be boiled down to: Tough choices await us ... but we're not going to address them just yet. Hill proposed a real estate tax rate increase of 2.5 cents to $1.155 per $100 assessed value, even though assessment increases from 2017 to 2018 should have covered the government's needs without touching the tax rate.

2018-02-28: FCTA: Arlington Real Estate Tax Increase, 1.3%... compared to Fairfax Co's 4.85%

Public posting, page A4 in the Washington Times. Includes an average increase of 1.3 percent for residential and no increase for non-residential real estate. (Fairfax County residents should be so lucky in 2018!)

2018-02-24: FCTA: Fairfax County Town Hall Budget Meeting in Vienna, by Charles McAndrew

In FY2019, General Fund Revenues will increase 4.69% over FY2018, and General Fund Disbursements will increase 4.42% over FY2018. And with real estate assessments rising an average of 3%, it appears hese rates are more than DOUBLE the inflation rate. The recommended Real Estate Tax rate will be $1.155 per $100 of assessed value -- an increase of 2.5 cents.

2018-01-19: Sun Gazette: Va. Senate keeps rqmt for meals tax referendum, by Brian Trompeter

Measures in Richmond that would have allowed the Fairfax County Board of Supervisors to impose a meals tax in the county without voter approval have been dispatched to the political graveyard for 2018. The same measures would have allowed localities to up their meals-tax rates to 8 percent, double the current rate -- a rate imposed on top of the 6-percent sales tax.

2017-12-18: WaPo: Gov McAuliffe proposes higher taxes in NoVa to support Metro - R. McCartney

Northern Virginians would pay higher taxes on real estate sales, hotel stays and wholesale gasoline to provide Metro with long-sought dedicated funding under a proposal to be announced Monday by Gov. Terry McAuliffe (D). The new tax revenue of $65 million a year would be in addition to $85 million that Northern Virginia already earmarks for Metro.

2017-07-20: FCTA: Resolution to fund Metrorail without tax increases, by Arthur Purves

Resolved, that FCTA: 1) urges the Fairfax County Board of Supervisors to oppose all tax increases for WMATA; 2) urges the Supervisors to instead recommend funding Metrorail capital needs from rail system tax revenues; 3) urges the General Assembly to allow transportation taxes to be used for capital costs as well as new construction; and 4) urges WMATA to declare bankruptcy if capital needs cannot be funded without yet another tax hike.

2017-05-01: FxCo: FY2018 Adopted Budget Package

2017-04-12: Sun Gazette: Fx budget hearing brings usual back-and-forth, by Brian Trompeter

The Fairfax Co public budget hearings on April 4-6 got the usual pleas from education backers, but also from residents seeking fiscal restraint. Jim Parmelee held up a No-Meals-Tax campaign sign used in last fall's referendum defeat. And Joe Connor recalled former FCPS Superintendent Karen Garza stating that "school officials had nothing else to cut except services to the students".

2017-04-06: FCTA: Fairfax County needs to Fix its Pension Problem, by Charles McAndrew

The pensions in Fairfax County are currently unsustainable. The county needs to raise the retirement age and adopt something similar to the Federal Government's "FERS" pension plan.

2017-04-04: FCTA's Arthur Purves' Presentation to Fx Co Supervisors

2017-03-23: Connection: MCA Casts 'Painful' Outlook for County's Budget, by Fallon Forbush

The McLean Citizens Association hosted a meeting to discuss the county's $4.10 billion advertised budget at the McLean Community Center on March 16. There was a lot of moaning and groaning from Fairfax County and school representatives.

2017-03-17: WT: Fairfax County budget notice advertisement -- Takes up all of page 2

2017-02-29: WJLA: Fairfax County questioned in $7 Million land deal, by Chris Papst

Finances are tight in Fairfax County. Some worry its credit rating may fall, and taxes may be increased. The county needs money, but that didn't stop its supervisors from recently approving a $7 million land deal with a big-time political contributor.

2017-02-26: FCTA: Email to FCRC, Fairfax GOP BOS discussing tax increases, by Arthur Purves

Republicans have campaigned for tax cuts and against Obamacare. However now that they're in position to do both, we're told they have no plan on how to do either. It is only two years before the next supervisors election. Now is the time to build public support for tax cuts. Waiting until September 2019 is too late.

2017-02-15: WTOP: Metro costs could bog down budgets for schools, police, by Max Smith

Schools, roads, public safety and other key budget needs could be squeezed out by ballooning needs at Metro after years of neglect, Nothern Virginia leaders were warned Tuesday. Fairfax County expects to contribute $61 million in capital funds and $20 million in operating money for the coming fiscal year's Metro budget.

2017-02-14: Sun Gazette: Fairfax RE tax bills up $40 in budget proposal, by Brain Trompeter

Proposal by county executive leaves school system $60 million short of what it seeks.

2017-02-14: WaPo: Fairfax Co trims budget requests as revenues stay tepid, by Antonio Olivo

Fairfax County Executive Edward L. Long Jr. on Tuesday proposed a 2018 budget that would give county schools $61 million less than they are seeking, one of several hard choices he said the wealthy suburb must make as it struggles with tepid revenue and a public rejection of tax hikes.

2017-02-14: FCTA: FY 2018 Budget Meeting by Ed Long, by Charles McAndrew

Homeowners: The current rate of the Real Estate tax will remain at $1.13 per $100 of assessed value (but the average assessed value will go up). The average real estate tax bill will increase approximately $40 for the homeowner.

2017-02-06: FCTA: Real estate taxes could increase 12% this year, by Tom Cranmer

FCTA's Tom Cranmer estimates that the Fairfax County real estate tax rate could go up 12% this year, after factoring in additional Metro subsidies, loss of Federal funding due to Fairfax's sanctuary county status, and increased funding demanded by the school system.

2017-01-29: Connection: Fairfax County Budget Breakdown

More than 50 percent of Fairfax County's $3.988 billion budget will be transferred to Fairfax County Public Schools, $68 million less than FCPS requested.

2016-12-01: Sun Gazette: Budget-bleating season begins anew in Fairfax County -- Editorial

It may be wishful thinking, but perhaps the supervisors were chastened enough by the overwhelming opposition to the meals-tax proposal that they will "suggest" that the School Board dust off last year's discarded task-force report on projected cuts, and start implementing them.

2016-11-22: FxCo: County budget forecasts underscore revenue challenges for FY 2018

The county projects only $74 million in additional revenue in FY 2018 (begins July 1, 2017) to cover:

-- $90 million in county funding priorities, not including many significant items.

-- $134 million in FCPS disbursement requirements (funding needs).

2016-11-09: Sun Gazette: Fairfax electorate again rejects a meals tax, by Brian Trompeter

Stick a fork in it. Fairfax County's proposed meals tax is done. Twenty-four years after the last time they rejected a meals-tax referendum, Fairfax County voters on Nov. 8 sent a similar proposal back to the kitchen uneaten. The proposal, the most contentious local item on the ballot, went down to defeat in all nine county magisterial districts.

2016-11-08: FCTA: Four reasons to vote AGAINST the Fairfax County meals tax, by Arthur Purves

1) You cannot trust Fairfax County; 2) Residential real estate taxes are increasing faster than household income; 3) Even with a meals tax, taxes will continue increasing faster than household income; 4) The Board of Supervisors and School Board are ignoring the causes of tax increases.

2016-10-25: WT: Fairfax County is trying again to impose a 'meals tax' -- Vote NO on Nov 8

2016-10-12: Sun Gazette: Vote down the Fairfax meals tax ... AGAIN! -- Editorial

The meals tax is another case of Fairfax County elected officials with sticky fingers, ready to use local residents as an ATM to fund a county government that too often must be reminded that power flows up from the people, not down from the Government Center. Fairfax residents rejected a meals-tax referendum in 1992; they should do so again.

2016-10-06: Fx Free Citizen: The Meals Tax: A Band-Aid, Not a Solution, by Arthur Purves

You have probably received the Fairfax County pamphlet "2016 Meals Tax Referendum: It's Your Decision". It was printed and mailed to 400,000 Fairfax County households at taxpayer expense. The pamphlet misleads voters into believing that the meals tax will result in lower real estate tax hikes. ...

2016-09-23: Watchdog.org: Texas' pile of debt, and shadowy bond votes, by Kenric Ward

"Alarming levels" of local government debt are nudging Texas lawmakers to bring more transparency and accountability to bond elections. Much of the debt has been piled on by taxpayers who vote for bond issue after bond issue. (Gee, that sounds awfully familiar!)

2016-09-22: Sun Gazette: Vienna could up meals tax to pay for parking garage, by B. Trompeter

Vienna Town Council members at a Sept. 19 work session discussed the possibility of increasing the tax from 3 percent to 4 percent -- on top of the 6-percent state sales tax -- to finance a future parking structure. The tax hike would end after a specific period unless town officials kept it in place permanently to pay for other projects.

2016-09-02: FxCo: Public Hearing on Supplemental Funds Appropriation

Posted as part of "FY 2016 Carryover Budget Package". A quick summary (WT ad#14904116, 9/02, 9/09):

FY 2017 Current Approved Budget Plan . . . . . . . . $7,471,661,174

FY 2017 Proposed Increase (27.69%) . . . . . . . . $2,069,172,164

. . Proposed Funding Increase . . . $1,782,361,466

. . Additional Funding Adjustments . $286,810,698

FY 2017 Proposed Total Expenditures . . . . . . . . . $9,540,833,338

2016-06-23: Reston Now: Special Reston Transportation District Tax Options Taking Shape

The Fairfax Co Dept of Transportation is still considering a special tax to fund $2.6 billion in transportation improvements in the Reston area in coming years. Two ideas include $0.03/$100 of assessed values for commercial and industrial properties in Reston transit station areas or a service district of $0.015/$100 for all properties in Reston transit station areas.

2016-06-21: Montgomery Co: Individual and Business Tax Burdens in Local Jurisdictions

This report analyzes and compares the tax burden for individuals living in and businesses based in Montgomery County (MD), Fairfax County (VA), The District of Columbia, Prince George's County (MD), Howard County (MD), and Frederick County (MD).

2016-06-08: Sun Gazette: Be More Creative Than Imposing a Meals Tax, by Sam Lowenstein

Perhaps a better way to diversify the revenue base of the county is to have a special tax on new automobiles bought for teenagers. After all, folks in Northern Virginia can live without eating out, but who can deny their kid a new Beemer?

2016-06-07: FxCo: Supervisors approve 4% Meals Tax referendum for Nov election ballot

Estimated $99 million in revenue. Allegedly, schools would get 70% and County Services, Capital Improvements and Property Tax Relief would get 30%. (But of course the real purpose is to improve county Pensions and Benefits. Wonder what they'll come up with to tax in 2017.)

2016-05-19: Reston Now: Transportation Tax District Wouldn't Include All of Reston

Fairfax County Department of Transportation officials want to create a special tax district to fund about $2.6 billion in transportation improvements in Reston. At a community meeting Wednesday, these officials said the idea is still on the table -- but only for residents and businesses in developments within the Reston's transit area.

2016-05-18: FCTA: Time for Fairfax Supervisors to Recognize Metro Costs, by Thomas Cranmer

Fairfax County's proposed budget this year had a deficit of nearly $100 million. The deficit next year is likely to be similar. So for next year add $100 million plus the extra Metro subsidy of $226 million, Fairfax would have a deficit of over $300 million. This is huge.

2016-05-10: WaPo: Fx Co may put meals tax on Nov. ballot June 7, by Patricia Sullivan

The Board of Supervisors has agreed to vote June 7 on whether to place a proposal on the general-election ballot to levy a 4 percent meals tax on all prepared foods and drinks -- from meals served at sit-down restaurants to takeout grub at grocery stores, fast-food franchises and cafes. (How will they tax us next year!?)

2016-05-03: Fx Free Citizen: Fx Co 2017 Budget, Meals Tax, and Spending, by Pat Herrity

Fairfax County Supervisor Pat Herrity (Springfield District) expresses his thoughts on the county's perennial 'Groundhog Day' budgeting process, loss of the commercial tax base, pension costs, the upcoming 4% meals tax proposal, and the county's inability to control spending.

2016-04-xx: FCTA: Budget in 1971 - Fx Co $294.5M, FCPS $79.7M -- Blast from the past

2016-04-25: FxCo: FY2017 Adopted Budget Package

2016-04-20: Reston 20/20: Details on the Proposed Reston Transportation Tax District

Who benefits from the new Reston transportation tax? The short answer is that Reston residents would have an added tax burden with no discernible benefit while landowners' for-profit development is subsidized by homeowner taxes and the County has a new tax revenue stream.

2016-04-18: Reston Now: New Reston tax service district is bad idea, OpEd by Terry Maynard

You thought your current real estate taxes are high? Restonians are once again faced with the prospect of the burden of an added local "tax service district" that could add hundreds of dollars to their annual property tax bill every year. (Virginia has allowed Fx Co to do this without a referendum.)

2016-04-08: Fx Times: Local restaurateurs pan idea of Fx Co meals tax -- letter

Now that elections are over, some Fairfax County Supervisors are looking again at a 4% meals tax referendum in the fall. (The last one in 1992 was defeated.) Three local restaurateurs explain why this would be a bad idea.

2016-04-06: Sun Gazette: Water, sewer rates to rise in Vienna, by Brian Trompeter

The Vienna Town Council voted 6-1 April 4 to approve proposed water-and-sewer rate increases for fiscal year 2017. A 66-cent hike per 1,000 gallons will raise the average homeowner's quarterly water-and-sewer bill by about $11, beginning May 23.

2016-04-05: FCTA Presentation to BOS on Real Estate Tax Increases and County Budget

FCTA Board Member Charles McAndrew and wife Linda address the Board Of Supervisors.

2016-04-05: FCTA's Tom Cranmer's Tax Comments to the Fairfax County Board of Supervisors

2016-04-05: FCTA's Arthur Purves' Presentation to Fx Co Supervisors

2016-03-23: FCTA: Fairfax Co budget townhall meeting in Springfield, by Charles McAndrew

County Exec Ed Long proposed a 4.8% budget increase. Pat Herrity (R-Springfield) talked about FCPS' second pension plan added in 2001, and Fairfax County's underfunding of the Virginia Retirement System (VRS). Herrity was the only supervisor to declare he would not vote for ANY tax increase.

2016-03-22: FCTA: Vienna proposes a 2.05% real estate tax increase

A "Notice of Public Hearing for Proposed Budget for FY2016-17 (scheduled for April 4) was published on page B5 of the Washington Times on 03/22/2014 and 03/29/2014. But unlike the Fairfax County notice, which states outright that it "proposes to increase property tax levies", Vienna's notice makes no such mention.

2016-03-14: Sun Gazette: Proposed Vienna budget holds tax rate steady, by Brian Trompeter

Vienna Town Manager Mercury Payton's proposed $33.8 million FY2017 budget would maintain the current real-estate tax rate of 22.5 cents per $100 assessed valuation, increase overall spending by 1.9% and give town employees 2.9% pay raises. Higher assessments will increase the average property owner's bill by 2%, to $1,564. Water-and-sewer rates will also be raised slightly.

2016-03-10: Connection: Fairfax County 2016 Assessments by Area

2016-03-09: Sun Gazette: Some Fairfax supervisors too tax-happy -- OpEd

Once again, Supervisor Linda Smyth (D-Providence) proved one of the few fiscally sane members of the board, pointing out that some of her constituents are set to be hit with a double whammy: higher overall real-estate taxes and a higher surcharge for living in Tysons Corner.

2016-03-07: Fairfax chasing taxpaying residents out of the County

Fairfax County taxpayers cannot afford Cadillac health plans, pensions, and annual 3.5%-4% raises for 34,000 county and school employees. Also of the 24,000 school employees, only 9,000 are regular classroom teachers.

2016-03-03: FCTA: Fairfax County Notice of Proposed Real Property Tax Increase

First public posting, one half of page A9 in the Washington Times. Includes an average increase of 1.64 percent for residential and an increase of 2.87 percent for non-residential real estate. Public hearing April 5, 2016 at the Gov't Center.

2016-03-02: Reston Now: Fairfax Supervisors Have Food Fight Over Tax Hike, by Karen Goff

Hours after passing a motion for an advertised 4-cent hike in real estate taxes for FY2017, some members of the Fairfax County Board of Supervisors asked for a practically unprecedented do-over. That led to a tense discussion and vote to reconsider at the end of Tuesday's seven-hour Board of Supervisor's meeting -- as well as a supervisors' shouting match after the meeting adjourned.

2016-03-01: Sun Gazette: Homeowners to get 4-cent Fairfax tax increase, by Brian Trompeter

After swatting down two proposals for even higher rates, the Fairfax County Board of Supervisors voted 7-3 March 1 to advertise a real estate tax rate of $1.13 per $100 assessed value for the county's fiscal year 2017 budget, a 4-cent increase over the current rate.

2016-02-25: FxCo: FY2017 Budget Chat with County Executive Ed Long

2016-02-20: Fairfax County's Gold-Plated FY2017 Budget -- Also in PDF: Color and B

How can taxpayers afford Fairfax County and School employees' Cadillac health plans, pensions with retirement at 55, and 3.5% annual raises?

2016-02-20: FCTA: Fairfax Co budget townhall meeting in Vienna, by Charles McAndrew

County Exec Ed Long proposed a 4% budget increase, which would cover some of the FCPS budget gap; Cathy Hudgins wants to reintroduce a 4% MEALS TAX referendum; and most attendees (from Reston, Vienna, Herndon) supported both measures. During Q, it was noted that the $120M 2010 "Transportation" bond funds mysteriously disappeared, while 85% of the $100M 2015 bond funds are for bikes and sidewalks.

2016-02-16: Reston Now: Fx Co proposed budget: Higher taxes, less for schools, by Karen Goff

Fairfax Co Executive Ed Long presented a proposed $3.99 billion budget Tuesday to the county Board of Supervisors that includes a real estate tax increase of 4 cents (to $1.13) for every $100 of value for Fairfax County homeowners. FCPS, meanwhile, will not get its requested 6.7% increase.

2015-11-24: WaPo: Fairfax school, county officials meet, talk budget cuts, by Antonio Olivio

Fairfax County is projecting a budget shortfall of as much as $85 million for fiscal 2017, and the school system is facing a budget gap of $60.6 million. The budget gap in part reflects the ongoing effects of about $2.6 billion in federal spending cuts in the region since 2012... (Not to mention the continued wasteful spending by those same school and county officials.)

2015-11-18: Sun Gazette: Fairfax gov't, schools have too much cash -- letter, by Bill Frazer

The average compounded inflation rate from 1987 to 2015 was 2.65%. The average compounded increase in my property taxes from 1987 to 2015 was 5.25%. That means that the amount of taxes being paid to Fairfax County has increased at almost double the rate of inflation since 1987.

2015-11-05: WaPo: Safely reelected, Chairman Bulova reconsiders meals tax, by Antonio Olivo

It's Baaaack!!! In June 2014, Fairfax Co Chairman Sharon Bulova decided the proposed 4 percent meals tax referendum would not be acceptable to voters in 2014 (due in no small part to efforts by FCTA president Arthur Purves). So she shelved the proposal until after the 2016 election. Well that time has come... Caveat emptor!

2015-11-03: FCTA: 2015 Fx Co Board-Of-Supervisors Election Winners, by David Swink

2015-10-14: Connection: Stark Differences for Fx Co Chairman: Bulova vs Purves, by Ken Moore

Anti-taxer Arthur Purves challenged incumbent Chairman Sharon Bulova at the Great Falls debate on Sept 29. Bulova said the county is balanced between taxes and services, and praised Metro's Silver line. Purves countered that the county is losing ground economically, taxes are too high, and the VDOT's upcoming I-66 proposals are excessive and will not improve traffic conditions.

2015-09-10: WAMU: Big Burden On Region's Taxpayers Forecasted In Metro Budget Proposal

"Given current trends, this subsidy growth appears likely to continue if no changes are made, but some jurisdictional representatives have been clear that large year-over-year funding increases to Metro cannot be supported," according to the budget analysis.

2015-09-04: FxCo: Public Hearing on Supplemental Funds Appropriation

Posted as part of "FY 2015 Carryover Budget Package". A quick summary (WT ad#14845824, 9/04, 9/11):

FY 2016 Current Approved Budget Plan . . . . . . . . $7,129,871,629

FY 2016 Proposed Increase (23.02%) . . . . . . . . $1,641,191,350

. . Proposed Funding Increase . . . $1,468,642,831

. . Additional Funding Adjustments . $172,548,519

FY 2016 Proposed Total Expenditures . . . . . . . . . $8,771,062,979

2015-07-22: WT: Prince George's spending problem a warning to other counties, by David Keene

There are no doubt countless other county bureaucrats running around "doing their jobs," and not one of them is costing enough to break the county, but together they are a sign of a governmental inability to prioritize or budget effectively. So no matter how much money government raises at any level, it seems incapable for lack of funds of fulfilling its core mission.

2015-07-07: Connection: Frey gives his final "State of Sully" address, by Bonnie Hobbs

In a speech on June 24, retiring Supervisor Michael R. Frey (R-Sully) mentioned that the county could sell bonds to raise money for projects, but "we have to have a balanced budget. Interest payments can't exceed 10% of the General Fund; we're hovering around 9% now. Our General Fund budget is $3.8 billion, so we could pay debt payments of about $380 million a year."

2015-06-30: Fx Ti404: Next year's budget shortfall deserves attention today, by Pat Herrity

Fairfax County is forecasting a $100 million shortfall for next fiscal year and the school system is forecasting their own $100 million shortfall as well. One would think that the Board of Supervisors and the School Board would begin addressing the shortfall today while we have time to review our very complex organizations and budgets. Not so!

2015-05-28: Fx Ti404: School Board approves $2.6 billion budget, by Kate Yanchulis

The board voted 10-2 at its meeting last Thursday night to pass a $2.6 billion fiscal 2016 budget that avoids major cuts and includes funding for later high school start times and 3 percent pay raises for most employees. But the cash-strapped school system is already looking toward the next round of the budget cycle.

2015-05-13: Fx Ti404: FCPS education officials seek to finalize budget, by Kate Yanchulis

School officials asked for a 3.99 percent increase in funding from the county, $70.6 million more than last year. The county last month approved an increase of $56.7 million, about $14 million short. While state-level budget adjustments make up for part of the deficit, FCPS is left with a $7.6 million hole to fill, and planned employee pay raises could take a hit.

2015-04-29: Fx Free Citizen: Stop the Fx County Tax Hikes, by FCTA's Fred Costello

The BOS raised real-estate taxes so they could give their major supporters (the county and school employees) raises far exceeding those given to most county residents.

2015-04-24: FCTA: Vienna posts final notice for budget and real estate tax increase

The Town of Vienna proposes real estate tax rate remain unchanged, so your (4%+) assessment increase will be the same as your next tax bill. (Final adoption May 11.)

2015-04-21: FxCo: Ten Principles of Sound Financial Management -- Updated

The Ten Principles, adopted by the Board of Supervisors on October 22, 1975, endorsed a set of policies designed to contribute to the County's fiscal management and maintain the County's "triple A" bond rating. Changes were adopted on April 21, 2015 to increase the County's reserve policies and financial position.

2015-04-21: FxCo: FY 2016 Budget Mark-Up Package

2015-04-09: Fx Ti404: FCPS education officials appeal for more funding, by Kate Yanchulis

Most who spoke before the Board of Supervisors recognized that with competing priorities and a tight budget, the county does not have enough to go around. State-level budget adjustments are expected to fill part of the gap, but FCPS still would have to deal with a projected $7.5 million deficit.

2015-04-09: Fx Ti404: Fx Co employees fight for larger pay increase, by Kali Schumitz

Fairfax County employees came out in force to a Wednesday budget hearing to implore county supervisors to uphold the agreement they negotiated with employee unions last fall. BOS Chairman Bulova said supervisors will work to bolster the county pay package in the coming weeks.

2015-04-07: FCTA Presentation to BOS on Real Estate Tax Increases and County Budget

FCTA Board Member Charles McAndrew and wife Linda address the Board Of Supervisors.

2015-04-07: FCTA's Arthur Purves' Presentation to Fx Co Supervisors

2015-03-27: FCTA: Vienna proposes a 5.46% real estate tax increase

A "Notice of Public Hearing for Proposed Budget for FY2015-16 (scheduled for April 13) was published on page B6 of the Washington Times on 03/27/2014 and 04/03/2014. But unlike the Fairfax County notice, which states outright that it "proposes to increase property tax levies", Vienna's notice makes no such mention.

2015-03-25: FCTA: Fx Co savings if private sector policies adopted, by Fred Costello

2015-03-20: FxCo: Notice Appropriating Supplemental Funds -- Add'l $117,387,455 for FY2015

2015-03-05: FCTA: Fairfax County Notice of Proposed Real Property Tax Increase

First public posting, one half of page A8 in the Washington Times. Includes an average increase of 3.4 percent for residential and a decrease of 0.6 percent for non-residential real estate. Public hearing April 7, 2015 at the Gov't Center.

2015-02-20: FxCo: County Executive Ed Long responds to FCTA budget questions

In a Feb 20, 2015 online chat, Fairfax County Executive Ed Long was asked by FCTA president Arthur Purves: 1. Last year, how many applications were there for every job opening? (Schools: 15,000 applications for 1,500 jobs. County: 200,000 applications for 1,000 jobs.) 2. How many county employees resign due to inadequate salary? (No answer.)

2015-02-19: WaPo: Facing budget deficit, Fairfax finds small savings, but ignores real cuts

The proposed small cuts raised the ire of Arthur Purves, who heads the Fairfax County Taxpayers Alliance and opposed a proposed $32 million in raises for Fairfax's 12,000 county employees. "They're giving raises and pensions and health care for employees higher priority than the programs," Purves said.

2015-02-18: Sun Gazette: Home assessments up all across Fairfax County, by Scott McCaffrey

The average value of single-family homes rose 3.3 percent to $620,080 countywide, while the average assessed value of attached homes (townhouses and rowhouses) rose 3.8 percent to $385,338 and the average assessment of condominiums rose 4.5 percent to $259,752.

2015-02-18: Connection: Stalled Labor Market Slows County Budget => budget pie chart

Commercial assessments dropped 0.6%, while residential assessments increased 3.4%. Commercial vacancy rates are higher than they have been since 1991.

2015-02-17: WaPo: Fairfax's budget choices are all bad ones -- County Executive Ed Long

The proposed FY2016 budget would address projected shortfall by cutting 45 county jobs, offering limited raises for government employees, cutting $14 million from what the county school system asked for, and cutting about $25 million from libraries, family programs and other services. Real estate taxes would increase about $185 (3.39%) on average.

2014-12-02: WaPo: Facing $173 million budget gap, Fairfax faces possible lower bond rating

Moody's in January attached a "negative outlook" to Fairfax's general obligation bonds, used to pay for schools, roads and other infrastructure improvements. Moody's cited Fairfax's underfunded pension systems and emergency budget reserves, which are comparatively lower than those kept by other governments with triple-A bond ratings.

2014-11-28: Sun Gazette: Budget pressure mounts for Fairfax -- Soft commercial real estate

County tax assessors are expecting a decline in commercial real estate values and only a 3 percent increase in home prices for fiscal 2016, less than originally projected. The county is also bracing for the potential impact of state budget cuts. Gov. Terry McAuliffe (D) will release his proposed budget in mid-December.

2014-11-26: FCTA: Results of the Fairfax County Budget Forecast Meeting, by Chuck McAndrew

Mr. Long presented a bleak picture for the FY 2016 and FY 2017 Fairfax County General Funds and School Funds due to continued restrained revenue growth -- slow job growth, very weak commercial market (highest vacancy rate since 1991), and lower than projected residential values.

2014-11-25: FxCo: County and FCPS budget forecast presented for FY2016 and FY2017 -- Slides

Fairfax County is facing budget shortfalls due to the tepid recovery in the residential and commercial real estate markets and increasing spending requirements. And the ripple effects of federal and state budget issues continue to impact county revenue, including sales tax receipts; the Business, Professional and Occupational License (BPOL) tax; and hotel taxes.

2014-11-25: WaPo: Fairfax Co facing $179 million budget shortfall in the next two years

Fairfax County officials are projecting a budget shortfall of $100 million for the coming fiscal year, and $79 million the following year, because of the lackluster recovery of residential property values and the highest office vacancy rate since 1991.

2014-10-23: Fx Ti404: Fairfax Co, school officials search for budget harmony, Kate Yanchulis

The two sides agree easily on two points. 1) Both the county and its schools face needs that surpass their available resources. 2) Given the current economic climate, that is unlikely to change. Both sides faced projected shortfalls in last year's budget cycle and will again this year.

2014-10-15: Fx Ti404: New pay plan for Fairfax County employees (Ref: Fx Co and FCPS plans.)

After 18 months of discussion and negotiation, the Fairfax County Board of Supervisors and county employee organizations have reached a consensus on a new pay plan for employees, which includes performance-based pay and cost-of-living increases.

2014-10-14: FCTA: Fx Co Employee Compensation Work Group Recommendations + Additional Info

Here is the FCTA-requested proposed pay plan for Fairfax Co non-uniformed employees. In FY2016 (election year) 1348 employees would get 5.5% raises, another 2,775 would get 4.5% raises and another 1,206 would get 4% raises. Overall, although the market rate adjustment of 1.5% is less than inflation, this still looks like a much more generous pay plan than would be found in the private sector.

2014-10-06: RCA: Bleak Fx Co budget forecast, higher homeowner taxes likely -- Terry Maynard

Fairfax County is predicting little growth in property values over the next year, less than in its last forecast for FY2016, which is likely to mean higher real estate property tax rates. The County is expecting a $71.4 million dollar shortfall, nearly double the $37.6 million shortfall they forecast last year for 2016.

2014-10-03: Fx Ti404: Once again, taxpayers being kicked to back of the bus -- Rob Whitfield

NVTA and its allies at the Virginia Department of Rail and Public Transportation, MWCOG TPB and certain federal agency officials want to spend most of our money designated for transportation on transit projects without regard to their cost effectiveness or their impact on reducing regional highway traffic congestion.

2014-08-25: Sun Gazette: Economist still somewhat downbeat about N.Va. jobs, housing pictures

Four years ago, the Washington region had the nation's best economic prospects; now it's on the bottom of the list. The region has lost 21,000 federal jobs since the recession and likely will lose another 20,000 in the next several years.

2014-08-22: FxCo: Public Hearing on Supplemental Funds Appropriation

Posted as part of "FY 2014 Carryover Budget Package". A quick summary (WT ad#14780162, 8/22, 8/29):

FY 2015 Current Approved Budget Plan . . . . . . . . $6,967,595,254

FY 2015 Proposed Increase (24.62%) . . . . . . . . $1,715,652,795

. . Proposed Funding Increase . . . $1,481,405,708

. . Additional Funding Adjustments . $234,247,087

FY 2015 Proposed Total Expenditures . . . . . . . . . $8,683,248,049

2014-08-15: FCTA: Compare FY2014 Adopted Budgets for Fairfax (Overview,V1,V2) vs Chesterfield

FCTA has downloaded equivalent budget documents for Fairfax and another large county -- Chesterfield, south of Richmond. While Chesterfield's single document totals 379 pages and is concise and straightforward, Fairfax's three documents (371+499+639=1509 total pages) appear full of fluff and virtually unreadable. But you be the judge.

2014-06-23: Biz Journal: Restaurants get reprieve on Fairfax County meals tax

Fairfax County Board of Supervisors Chair Sharon Bulova doesn't expect the proposed 4 percent meals tax referendum to be acceptable to voters in 2014, so it will likely be delayed until after the 2016 election.

2014-06-22: Sun Gazette: Continued decline seen in average weekly wage across Fairfax

The federal Bureau of Labor Statistics shows Fairfax County's economy remains endangered despite the slow national recovery. Both the total number of jobs in the county, and the average weekly wages by those who hold them, posted year-over-year declines in the fourth quarter of 2013, according to figures reported June 19.

2014-06-21: FCTA: Fairfax County Loses Taxpayers to Other Virginia Counties

Fairfax County taxpayers with Average Gross Income (AGI) totaling over $6 billion have left Fairfax County. Most have moved to neighboring Loudoun and Prince William counties which have lower tax rates.

2014-06-17: FxCo: Meals Tax Referendum Task Force - Majority and Minority Reports

FCTA president Arthur Purves was a member of this Task Force, and wrote the Minority Report.

2014-06-11: Connection: Eat. Drink. Pay? (for Fairfax Co meals tax), by Victoria Ross

It has been 22 years since Fairfax County asked voters to approve a tax on restaurant meals, an issue that ignited protests, caused deep divisions among community leaders and threatened to melt down several political careers.

2014-06-11: FCTA: Lower Compensation or Higher Taxes? A Perspective on a Fx Co Meals Tax

2014-06-11: FCTA: Is a Meals Tax the Right Direction? -- Pros and cons

2014-06-11: FCTA: Facts and Figures -- Still think we need a Meals Tax?

2014-06-03: Say "NO" to a Fairfax County Food Tax! -- BOS wants 4% levy on prepared food

2014-06-03: Fx Free Citizen: Meals Tax Task Force a Political Ploy

Chalk up another one to clever Fairfax County politicians who will likely use the results of an ad hoc study committee they created (but gave way too little time to complete serious work) to validate their pursuit of a County meals tax. Another political ploy planned and executed smartly!

2014-05-27: Watchdog.org: Fairfax eyes $85 million more for bike-walk projects

A proposed $100 million transit referendum earmarks $85 million for new bikeways and pedestrian paths. The outlays come on top of more than $200 million in bike-ped projects already approved. "This doesn't make any more sense than a $1 million bus stop," Supervisor Pet Herrity said, referring to Arlington's notorious "Super Stops."

2014-05-24: WaPo: Fx Co considers reviving proposal to tax restaurant meals

Fairfax County is considering asking voters to approve a tax on restaurant meals, an issue that has been a political third rail in the wealthy jurisdiction and triggered angry rallies and threats of electoral ruin the last time it was considered, in 1992.

2014-05-07: Sun Gazette: Kelleher, Colbert, Majdi win in Vienna; DiRocco still mayor

2014-05-05: Sun Gazette: Vienna Town Council members, residents spar on tax burden

"The tax rates here are increasing unsustainably," said David Swink, a town resident who serves on the board of the Fairfax County Taxpayers Alliance. "It doesn't really matter whether you need it or not. You're taking it. People are just going to have to walk away. The taxpayer really has no say about it."

2014-05-02: FCTA: Vienna posts final notice for budget and real estate tax increase

The Town of Vienna proposes real estate tax rate remain unchanged, so your (8%+) assessment increase will be the same as your next tax bill. (Final adoption May 12.)

2014-04-29: Bulova request: FCTA join Meals Tax task force

Dear Mr. Purves, I am writing to invite you or a representative of the Fairfax County Taxpayers Alliance to participate in a task force to consider a Meals Tax referendum.

2014-04-24: Sun Gazette: Seeking more money, Fairfax convenes meals-tax task force

Not content with this year's 7.3% increase in real estate taxes, Fairfax County Supervisor Chairman Sharon Bulova proposed today creation of a task force (see below) to evaluate whether to place a meals tax referendum on the ballot at some point in the future. FCTA president Arthur Purves said even the imposition of a meals tax would not raise enough money to offset runaway county spending.

2014-04-24: Fx Co Supervisor Bulova wants to create a Meals Tax Referendum task force

2014-04-22: Reston Now: Fairfax Supervisors OK 7.3% Real Estate Tax Hike

The Fairfax County Board of Supervisors Tuesday voted to increase the real estate tax rate to $1.09 per $100 of assessed value, the biggest hike since 2007. The vote passed 7-3, with supervisors Pat Herrity (Springfield) , Linda Smyth (Providence), and John Cook (Braddock) voted against the rate.

2014-04-21: Fx Ti404: Fairfax Board of Supervisors debates key budget elements

The main budget package that Board of Supervisors Chairwoman Sharon Bulova (D-At large) will put forward tomorrow includes a slight increase in the real estate tax rate and $14.6 million in budget cuts. That money would be used to fund larger pay increases for county employees and more schools funding than was included in County Executive Ed Long's proposed budget.

2014-04-11: Sun Gazette: Vienna residents vent over rising town tax rate

FCTA's David Swink noted that Vienna's residential property taxes would increase a higher percentage than the town's overall budget. Swink said his property-tax bill remained flat from 1990 to 2000, but doubled between 2001 and 2007.

2014-04-10: FCTA's Tom Cranmer's Presentation to Fx Co Supervisors

2014-04-09: Change.org: Balance FY2015 budget without increasing property tax rate

You can sign a petition to the Fairfax County Board of Supervisors!

2014-04-08: FCTA Presentation to BOS on Real Estate Tax Increases and County Budget

FCTA Board Member Charles McAndrew and wife Linda address the Board Of Supervisors.

2014-04-08: Taxpayer Rally on Tuesday, April 8 at 6PM!

Join us at the taxpayer rally, at the start of the first night of the Board of Supervisors budget hearings.

2014-04-08: FCTA's Arthur Purves' Presentation to Fx Co Supervisors

2014-04-03: FxCo: BOS Chairman replies to FCTA's April 8 presentations

Chairman Sharon Bulova replies to Charles and Linda McAndrews' upcoming presentations, having been sent the FCTA letters in advance.

2014-04-02: Loudoun Times: BOS approve $2B budget, leave $38M shortfall for local schools

Loudoun's Board of Supervisors signed off on an approximately $2 billion fiscal 2015 county budget Wednesday night, which will hold taxes level for the average county homeowner -- a key goal stated by the nine Republican supervisors elected into office in 2011. The county's $600 million allocation to the schools in fiscal 2015 is the largest amount possible without a tax increase.

2014-03-28: FCTA: Vienna posts notice of real estate tax increase

The Town of Vienna proposes real estate tax rate remain unchanged, so your (8%+) assessment increase will be the same as your next tax bill. (Public hearing April 28.)

2014-03-28: FCTA: Sully District Mtg - Minutes

FCTA's Charles McAndrew and Rob Whitfield in attendance.

2014-03-21: FCTA: Vienna proposes a 7.5% real estate tax increase

A "Notice of Public Hearing for Proposed Budget for FY2014-15 (scheduled for April 7) was published on page B5 of the Washington Times on 03/21/2014 and 03/28/2014. But unlike the Fairfax County notice, which states outright that it "proposes to increase property tax levies", Vienna's notice makes no such mention.

2014-03-20: FxCo: Advertised Budget for FY 2015 Presentation - Updated (59 pages)

2014-03-20: FCTA: Dranesville District Mtg - Minutes

FCTA's Thomas Cranmer in attendance.

2014-03-11: Sun Gazette: Supervisors Drop the Ball in Advertising Higher Tax Rate

Memo to Fairfax County homeowners: You now know who your allies are on the Board of Supervisors. Patrick Herrity (R-Springfield) and Linda Smyth (D-Providence) did the right thing in opposing the board majority, which voted to advertise a tax-rate increase.

2014-03-11: FCTA: Fairfax Co Adjustments for Pay and Benefits 2000-2014

Information requested by FCTA from the county regarding pay and benefit data equivalent to what Fairfax County Public Schools had provided.

2014-03-06: WT: Fairfax County Notice of Proposed Real Property Tax Increase

First public posting, one half of page A8 in the Washington times. Includes an average increase of 6.54 percent for residential and a decrease of 0.10 percent for non-residential real estate. Public hearing April 8, 2014 at the Gov't Center.

2014-03-05: Supervisor Herrity on Budget/Tax Rate, School Budget, and more

A 15.5% tax increase over three years demonstrates the board has lost its sense of priorities... The $98 million School Board request to fund our schools can be easily met without a tax rate increase and why teachers can and should get a raise...

2014-03-04: Patch: Board of Supervisors Authorizes Advertised Tax Rate of $1.105

If approved, would be a 8.5% annual increase in the average real estate tax bill. Supervisors Herrity and Smyth vote against measure. Public hearings on budget and tax rate begin Tuesday, April 8.

2014-03-01: FCTA: Hunter Mill District Mtg - Minutes

FCTA's Charles McAndrew in attendance.

2014-02-xx: FxCo EDA: Major State and Local Taxes and Fees, FY2014

This report highlights major state and local taxes and fees. The first section focuses on tax information for businesses, followed by tax information for individuals. Also included are an overview of other taxes and fees, a directory of state and local agencies and neighboring jurisdictions, and a regional tax rate comparison.

2014-02-28: FxCo: County Executive Ed Long responds to FCTA budget questions

In a Feb 28, 2014 online chat, Fairfax County Executive Ed Long responded to three of ten questions posed by FCTA president, Arthur Purves.

2014-02-28: FCTA: Ten Budget Questions for the Board of Supervisors

The Fairfax County Taxpayers Alliance asked the Board of Supervisors to consider ten questions, which were submitted on the County's chat link before Feb 28. Three of these were answered. View the actual Q.

2014-02-25: FxCo: Fairfax County Executive Proposes $7 Billion Budget for FY2015

Proposed budget maintains the FY 2014 Real Estate Tax Rate at $1.085 per $100 of assessed value. Recommended operating transfer to Fairfax County Public Schools is $1.75 billion, a 2 percent increase over FY 2014.

2014-01-16: Watchdog.org: Prioritize schools, pensions, not 'bailing out a bank'

Fairfax County Supervisor Pat Herrity, R-Springfield District, was the lone dissenting vote against a board of supervisors move this week to take on $30 million owed by what's known as the Lorton Arts Center.

2014-01-09: Patch: Moody's Gives Fairfax County 'Negative Outlook'

As Fairfax County prepares to sell $305 million in bonds to raise money for schools, public safety and transportation programs, Moody's Investor Service slapped the county with a "negative outlook" tag.

2013-12-29: FCTA: Fairfax Co Budgets 1999 to 2014

FCTA's Fred Costello has compiled basic Fairfax County budget data for FY1999 through FY2014, as shown both graphically and in item-by-item detail.

2013-12-04: Biz Journal: Fairfax County's first billion dollar property

The Macerich Co.'s Tysons Corner Center is the most valuable, taxable property in the Washington area, and now it's got a number to prove it: $1 billion. The Tysons' assessment rose by $25 million over one year, and is likely to jump more next year as a result of the Silver Line opening.

2013-09-xx: FCTA: Fairfax Co Loses Taxpayers, Virginia Gains

Fairfax County had a net loss of $6.03 billion in annual Adjusted Gross Income (AGI) between 1992 and 2010. Meanwhile, the state of Virginia had a net gain of $3.30 billion in annual AGI.

2013-09-18: Henrico taxpayer group educates citizens on Meals Tax issue (1,2,3) -- et tu Fx?

The "Stop Henrico Meals Tax" organization has produced three animated videos to effectively expose Henrico's meals tax agenda in 2013. The same arguments would apply to Fairfax. -- 1. Just get the money (2:14); 2. Don't Disclose That! (6:03); 3. Henrico Parents Learn Truth About Meals Tax (2:18). UPDATE: Henrico's meals tax passed anyway.

2013-09-14: FCTA: Fairfax Co Real Estate Taxes Increasing More Than Twice as Fast as Inflation

The Fairfax County Board of Supervisors increased real estate taxes 100% (from $2400 to $4800) between 2000 and 2007. And 114% to date.

2013-09-14: FCTA: The Great Recession ... or the Great Bubble?

Reduced wealth since the "Great Recession" has not prevented increases in Fairfax County residential assessments.

2012-09-xx: Governing: Are Comprehensive Annual Financial Reports (CAFRs) Useless?

For all their charts and graphs, CAFRs don't tell public officials -- or the public -- anything about fiscal sustainability or whether a locality's finances might be trending south. What actually sinks city and county finances is that slow, steady accretion of bad -- and hidden -- fiscal news that either nobody is getting or no one wants to hear, like bond and pension obligations.

2012-02-11: WaPo: Fx Co supervisors discuss meals tax, roads, other issues at retreat

Also: Sharon Bulova wants to rewrite the rules that govern land-use decisions, which currently allows for intense deliberation and wide public involvement. "Citizens, you have no say!"

2011-06-17: Patch: Nielsen's Owner Arrested for Failing to Pay Vienna Meals Taxes

Michael Paul Willis, 28, of Vienna, the owner of the Nielsen's Frozen Custard, was charged with two counts of embezzlement for not paying Town of Vienna meals taxes during several periods over the last year.

2010-xx-xx: FCTA: Fairfax Co FY 2010 Adopted Budget