Virginia: No Tax Hike Needed for Transportation

Virginia has plenty of money for transportation, without additional tax hikes.

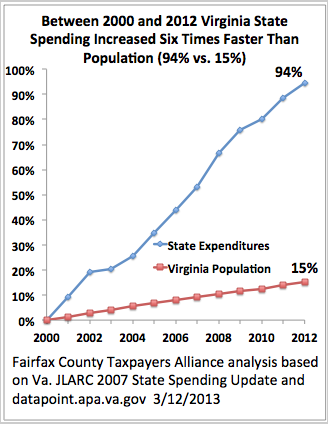

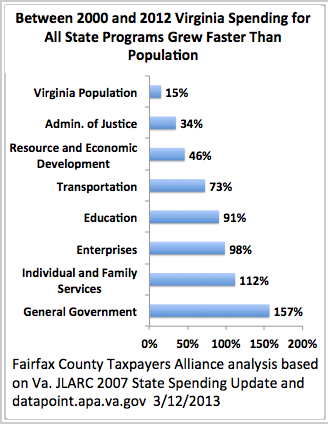

Between FY2000 and FY2012, the Virginia budget (General Fund + Non-General Fund) increased by $21 billion, from $22 billion to $42.7 billion, a 94 percent increase. Over the same period Virginia population increased by only 15 percent, from 7.1 million to 8.2 million.

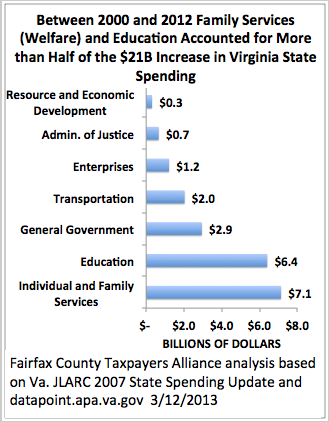

Of the $21-billion increase:

- $2 billion went to transportation, which increased 73 percent, from $2.8 billion to $4.8 billion

- 6.4 billion went to education, which increased 84 percent, from $7.1 billion to $13.5 billion.

- $7.1 billion went to Individual and Family Services (includes Medicaid), which increased 112 percent, from $6.4 billion to $13.5 billion.

These three items account for $15 billion of the $21 billion increase. The numbers above come from the Joint Legislative Audit and Review Commission (JLARC) Review of State Spending: 2007 Update, Review of State Spending: 2012 Update (see especially page 39 of the latter), and the Commonwealth Datapoint website. (There is a small inconsistency between JLARC and Commonwealth Datapoint numbers.) Spending is not adjusted for inflation, which is appropriate because private-sector wages are not keeping up with inflation.

How carefully have the General Assembly and the Governor managed these disproportionate increases in education and Medicaid spending?

According to the ACT college admissions test 2012 Profile Report for Virginia, of the 21,647 Virginia students tested, only 33 percent were prepared for college (p. 7). Of that sample, while 40 percent of white students were prepared for college, only 7 percent of African-American students were prepared, showing the state's neglect of minority student achievement (p. 22).

Despite being the largest and fastest-growing item in the Virginia budget, Medicaid is broken. The waiting list for Medicaid waivers, so disadvantaged persons can be cared for at home instead of institutions, has over 7000 names. For those lucky enough to get a waiver, the reimbursement rates are too low to retain caregivers. Reimbursement rates for doctors are low, making it difficult to find doctors accepting Medicaid. Fraud is a problem. Medicaid promotes dependency instead of self-sufficiency, and where charity is needed private charity is more efficient than charities run by politicians.

New taxes reward and subsidize the General Assembly's and Governor's failure to rein in out-of-control spending on education and Medicaid, programs that are not meeting their goals. Rather than raise taxes, elected officials should better manage the revenue they have.

Arthur Purves

President

Fairfax County Taxpayers Alliance

purves@fcta.org

02/21/2013