Spending Crisis in Fairfax County and Virginia

The FCTA is a non-profit, non-partisan, volunteer organization founded in 1956 to prevent excessive tax increases. We analyze government spending and speak out against government waste.

|

|

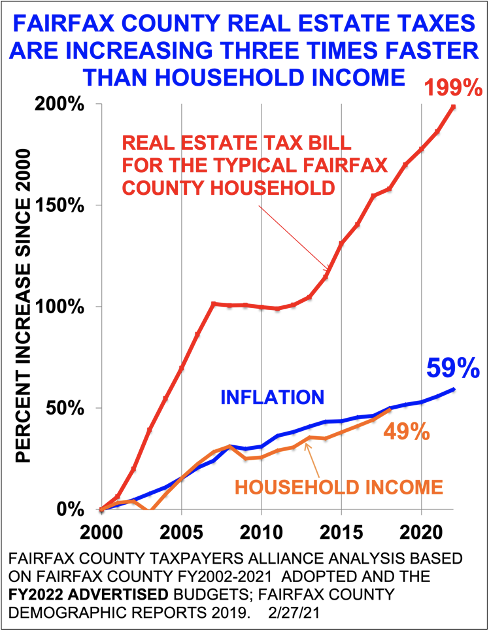

Since 2000, Fairfax County real estate taxes have increased more than twice as fast as family incomes. Some causes listed here.

- State and local government pensions are a problem in Virginia and Fairfax County. Pensions should be replaced with 401Ks.

- County salaries increase at double the rate in the private sector.

- School spending increases three times faster than family incomes, while test scores have fallen.

- Fairfax County's increasing proportion of lower-income families are taking advantage of generous Health and Welfare services -- $465M in 2019.

- Good roads sacrificed for spending on bike paths, and a dysfunctional and underutilized Metro. Silverline may be as much as 40% below projected use.

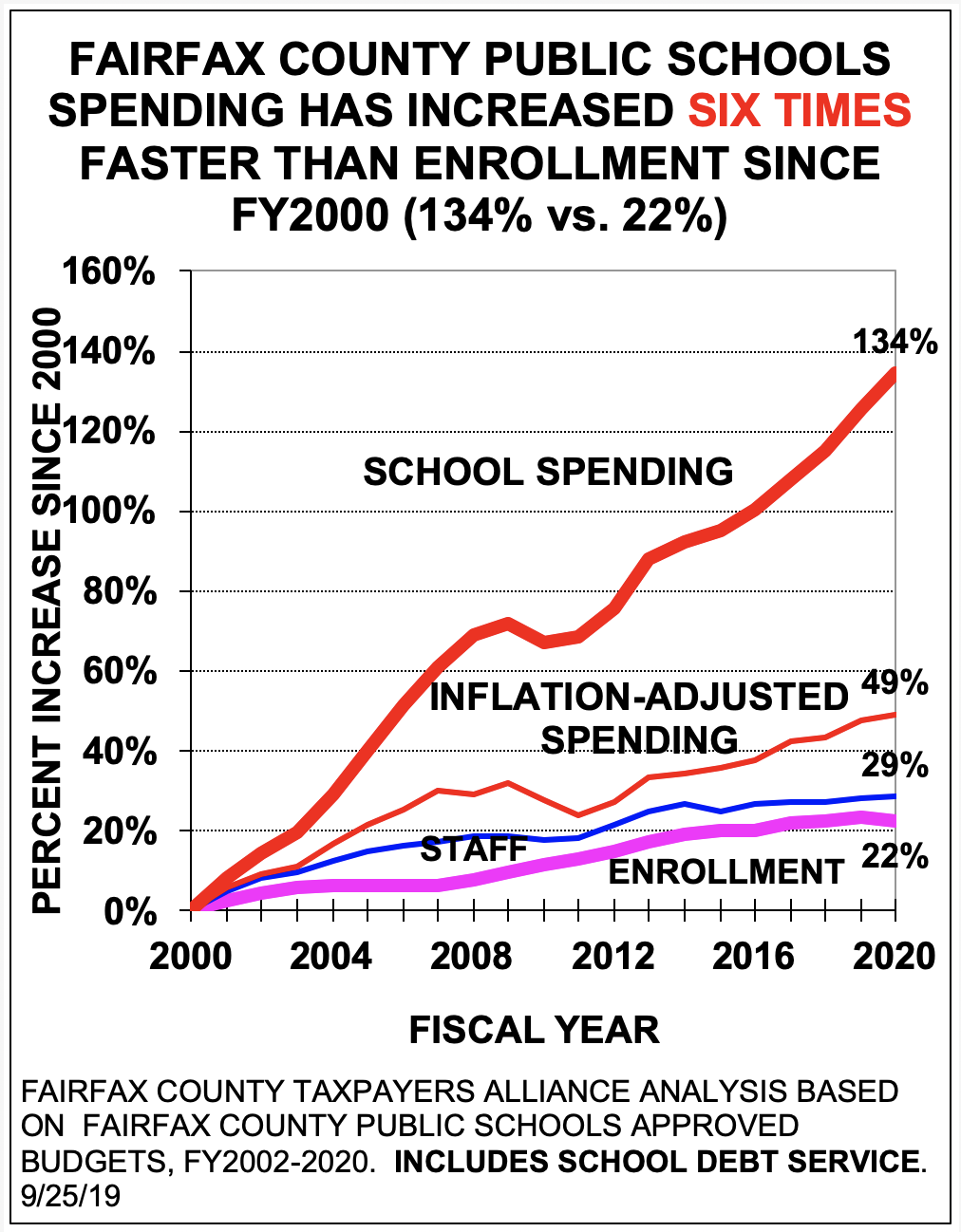

The school system, as shown in the second graph, eats up over 55% of the County budget, and has unsustainable spending increases. Regular classroom teachers are only 40% of school employees, and the curricula they are required to teach fails to address the decreasing academic performance of students in their charge.

Recent IRS data shows that middle income seniors are leaving Fairfax County, while lower-income families are replacing these wealthier residents. The County has lost over $14 billion in AGI since 2000.

FCTA supports the following business policies:

- End the regressive BPOL tax. Most states have. McAuliffe offered to drop BPOL in 2012, but it's still in effect in Virginia. End the tools and machinery tax.

- Adjust the small-claims limit for inflation from $5,000 to $20,000. Pro-se law is a right that pre-dates the constitution, and access to the courts helps commerce.

- Adjust the casual labor threshold for inflation from $600 to $2,000.

- Continue Virginia's Right-to-Work status -- Let businesses control their compensation and leave policies.

- Lower Virginia's 6% corporate tax rate to match North Carolina's rate of 2.5% (heading for zero). Virginia has lost about $5 billion in Adjusted Gross Income to NC in recent years.

Let FCTA help you advocate for lower taxes -- it's what we do! We attend town halls, budget meetings, and meet personally with state and local politicians.

Please join FCTA and help us advocate for you. Memberships are $25 paid annually. Details at: http://fcta.org/About/join-fcta.html.