From: Charles & Linda McAndrew / 12808 Willow Glen Ct / Oak Hill, VA 20171

Presentation to the Fairfax County Board of Supervisors on Real Estate Tax Increases - 04/12/2018

| To:† | Mrs. Sharon Bulova Chairman, Fairfax County Board of Supervisors Fairfax County Government 12000 Govt Center Pkwy Fairfax, VA 22035 |

Mrs. Kathy Smith Fairfax County Board Supervisor Sully District Government Center 4900 Stonecroft Blvd Chantilly, VA 20151 |

Dear Mrs. Bulova and Mrs. Smith:

|

|

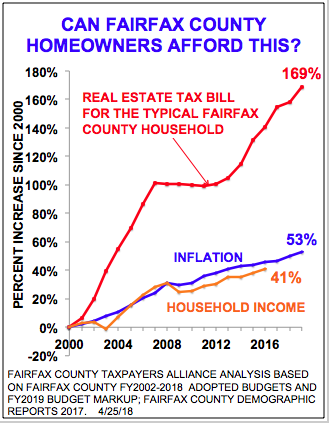

My wife and I have been homeowners and taxpayers in Fairfax County since 1968. Again, we protest the increases in the overall county budget and real estate taxes. As usual, the board plans to raise the county budget and the real estate rate along with the assessment increase more than twice the inflation rate for FY 2019. The FY19 General Fund Disbursements will increase $181.48 million or 4.42% over the FY2018 Adopted Budget which will be $4.288 billion. According to Kiplingerís News Letter February 2018, the official consumer price index (inflation rate) increased 2.1% for calendar year 2017. With the rate increase and the real estate assessment increase, the overall increase in real estate taxes is projected to be almost an average of 5%. For the last five years, real estate taxes have increased 26% which is almost three times the inflation rate for that period.

The Educational Employees Supplementary Retirement System of Fairfax County (ERFC) is an additional supplemental plan that applies to Fairfax County Public School (FCPS) employees who are on the Virginia Retirement System (VRS) and are paid the same amount of Social Security (SS) that he or she would receive at age 66. So if a teacher retires at 55 with 30 years of service, that teacher receives 75% of his or her retirement based on the highest three years of service and includes the SS supplement as if they were already on SS until they reach the SS age. No other county or city in the metropolitan area offers this very generous ERFC system. The proposed budget for ERFC is $94.6 million for FY 2019. This program should be phased out for those FCPS employees less than 40 years of age and terminated for all new employees.

The Deferred Retirement Option Program (DROP) allows employees retirement payments prior to actual retirement. DROP allows the employee to continue to work and receive their salary for a period of up to three years. During the DROP period, the pension plan accumulates the monthly benefit in an account balance identified as payable to the member only at the end of the DROP period. The monthly benefit that is credited to the DROP participant's account balance is calculated using service and final compensation as the date of entry in DROP, and the employee does not earn service credit toward retirement trust funds during the DROP period. In FY 2017, approximately $43.6 million in retirement benefits were paid out of the retirement trust funds as DROP lump sum payments. For FY 2019, the DROP budget is approximately $37 million. It is time to drop the DROP!

It is time for county officials to look at the costly defined benefit retirement systems and carefully review what the Federal Government did over 30 years ago when they went to a hybrid system called the Federal Employees Retirement System. In addition, the county should raise the retirement age to 67, which is the SS age to retire, for all new employees which is the same position of the Fairfax County Taxpayers Alliance (FCTA). Last, but certainly not least, is the Fairfax County Unfunded Pension Liability of $5.6 billion, which seems to be ignored by the County Board.

I look forward to your written responses.

Sincerely,

Charles McAndrew and Linda McAndrew

FCTA Board member

Response by Sharon Bulova - 06/20/2018

Dear Mr. and Mrs. McAndrew:

Sorry for the delay in my response. Thank you for writing me and sharing your concems about the Fairfax County Budget. As the Board of Supervisors approved the FY 2019 Budget in May, we continue to work through the Lines of Business process and the deeper evaluation into ernployee benefits. While the budget is based on a2 cent increase in the real estate tax rate, (an increase of $241 on the average annual tax bill) I believe the additional revenue is an important investment needed to shore up the foundation on which our quality of life rests.

Often, local govemment is at the bottom of the chain when new or added responsibilities are passed at the federal and state level. Or, when reductions are made at those levels, forcing local governments to pick up a greater burden. In Fairfax County, this is compounded by the fact that Counties in Virginia have very few revenue sources to provide local services. About 85% of our budget comes from property taxes (auto, home, business properties).

An example of "unfunded, or underfunded mandates" is education of children with developmental disabilities or other special needs (i.e. non English speakers). Federal law mandates educational requirements and standards, but only provides a very small fraction of the costs. In addition, another example is in the environmental arena -- cleaning up the Chesapeake Bay, protecting streams and waterways from destructive runoff. Costs for this are largely passed on to cities, towns and counties. These are all important things to do but funding them puts greater pressure on our residential and commercial tax payers.

Recent tax changes on the federal government level and proposed changes on the state government level could impact our taxpayers significantly. The challenge will be to continue making essential investments into our priorities necessary for long term success while balancing the needs of our taxpayers. Please be assured that our Board of Supervisors will work to find savings and efficiencies in the programs and services that the County provides. In this way we will seek to find ways to meet the priorities of the community we represent.

The County Executive has started a process to work on the strategic planning that aligns our board priorities and streamlines overall operations. This work will be influenced by the Lines of Business Phase II (LOBs) efforts. Our Board is committed to identiffing savings and efficiencies, examining services and programs for duplication or continued relevance. In addition, I am putting together with the assistance of staff, a public engagement process for individuals interested in following the LOBs in a more in-depth fashion.

On the benefits front, I believe that changes need to be made to some aspects of our benefit package in order for Fairfax County to remain fiscally sound in the future. In particular, I support raising the age of retirernent from 55 to 60 and I believe the pre-social security benefit should be eliminated. I also believe these changes should be effective for new hires and not employees who were hired under the existing benefit programs. The Board of Supervisors has begun to work on these issues through the personnel committee and package of changes to the benefit program is available at the Board Personnel Committee Meeting on May 22, 2018. Thank you for your commitment to these issues and adding your voice to the conversation during these budgetary meetings.

Sincerely,

Sharon Bulova

Response by Kathy Smith - 06/21/2018

Dear Mrs. Bulova and Mrs. Smith:

Thank you for your letter regarding the Fairfax County Fiscal year 2019 Budget. Every budget year is unique and challenging and this year was no different. As part of the Budget Guidance for Fiscal year 2020, the Board of Supervisors will look at employee pensions. The Board is committed to a defined benefit plan, but it also takes its fiduciary responsibility very seriously and will continue to make the decisions needed to ensure that a healthy system is in place. That entails addressing the unfunded liability within today's constrained budget environment.

At the June 26, 2018 Personnel Committee Meeting, the Board will discuss making changes to the system for hires/employees. These changes should help to ensure the stability of the system for years to come. Changes under consideration include raising the minimum retirement age, increasing the salary averaging from three years to five years, and eliminating the pre-social security supplement.

I appreciate your comments on the retirement system and will keep them in mind as the Board deliberates this issue.

Sincerely,

Kathy L. Smith