From: Charles & Linda McAndrew / 12808 Willow Glen Ct / Oak Hill, VA 20171

| To: | Mrs. Sharon Bulova Chairman, Fairfax County Board of Supervisors Fairfax County Government 12000 Govt Center Pkwy Fairfax, VA 22035 |

Mr. Michael Frey Fairfax County Board Supervisor Sully District Government Center 4900 Stonecroft Blvd Chantilly, VA 20151 |

Dear Mrs. Bulova and Mr. Frey:

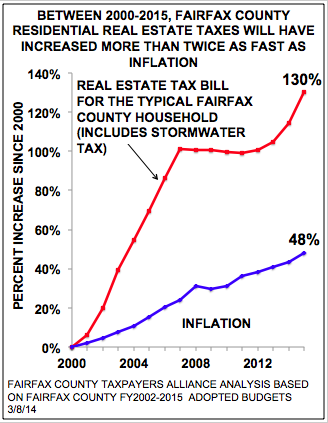

We want to protest the increase in the current rate to $1.1275 from the previous $1.1060. We feel there is no justification for this increase. We have had increases in our real estate taxes that almost doubled the inflation rate for the last seven years as noted on the chart below.

|

|

YEAR ASSESSED VALUE TAX RATE TAXES PD 2014 $671,360 * $1.1275** $7,570** 2013 $623,510 * $1.1060 $6,896 2012 $602,700 * $1.0960 $6,606 2011 $567,580 * $1.0860 $6,163 2010 $536,150 * $1.1060 $5,930 2009 $568,950 * $1.0510 $5,923 2008 $624,530 $1.0410 $5,752

In the past seven years, as you can see by this chart, our real taxes have increased from $5,752 to a projected $7,570 for 2014 for a whopping 24.0% increase! For the same period of time, inflation increased 13.1% as reported by the U.S. Bureau of Labor Statistics (they reported for the first two months of 2014 a rate of 1.3%, 1.5% for 2013, 2.1% for 2012, 3.2% for 2011, 1.6% for 2010, minus 0.4% in 2009, and 3.8% in 2008). These statistics show that our real estate taxes have increased almost twice the inflation rate for that seven year period. This is outrageous! Our current assessment increased this year by 7.1%. It appears that with the proposed tax rate of $1.1275 (which includes the storm water tax) and, as you can see by the chart above, our real estate tax could increase this year by 8.9% over last year which is almost SEVEN TIMES THE CURRENT INFLATION RATE.

According to the Fairfax County Taxpayers Alliance (FCTA), the residential real estate taxes increased $3,200 between FY2000 and FY2015. This simply means that, during this period, inflation increased 50% while the residential real estate increased 133% or more than twice the inflation rate. These figures include the storm water tax. How can you really justify increasing real estate taxes more than twice the rate of inflation? For decades, the County Board has been raising the budget and taxes more than twice the inflation rate!

In conclusion, we feel that the rates should be rolled back to $1.03, the amount needed to offset the increase in residential assessments according to the FCTA. We look forward to your comments.

* Includes storm water tax.

** Projected based on the latest proposed tax rate increase for 2014.Sincerely,

Charles McAndrew and Linda McAndrew