|

|

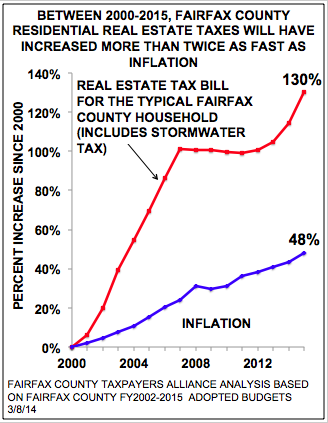

This year Fairfax County residential real estate assessments increased 6.5 percent. To prevent a residential tax hike, the tax rate would have to be reduced from the current $1.105 to $1.04. Instead the supervisors advertised increasing the tax rate to nearly $1.13, which means that the typical homeowner's real estate tax bill would have increased 133% (from $2407 to $5615) since FY2000.

Since FY2000, 77 percent of Fairfax County Public Schools (FCPS) $1.6 billion in increased spending was for compensation and only 23 percent for enrollment growth. Fairfax County government refuses to disclose what percentage of its spending increases was for compensation as opposed to population growth. Salary increases for FCPS employees average 4.6 percent annually since FY 2000. Spending per employee for pensions and health insurance increased 5.3 percent and 8.5 percent annually. Annual inflation was 2.8 percent. It is reasonable to assume that county government increases mirrored school compensation increases.

County and school employees can retire at 55 with 75 percent of salary and have health insurance plans with zero-deductible in-network. FCPS has about 30,000 applicants for 1,000 job openings; the county has 200,000 applicants for 1,000 job openings annually.

What does the taxpayer get in return? Last year’s FCPS SAT scores were at the 69th percentile. According to the ACT college admissions test, only 54 percent of FCPS seniors were prepared for college. Persons living in poverty increased 70%, from 43,000 to 74,000, between 2000 and 2011.

To prevent a residential tax increase and to reduce poverty, the Republican supervisors should make a motion to:

Even with a ten-percent salary cut, county and school employees would still have had better benefits and higher average annual raises since FY2000 than private-sector taxpayers.

alerts@fcta.org -- www.fcta.org -- 4/17/2014